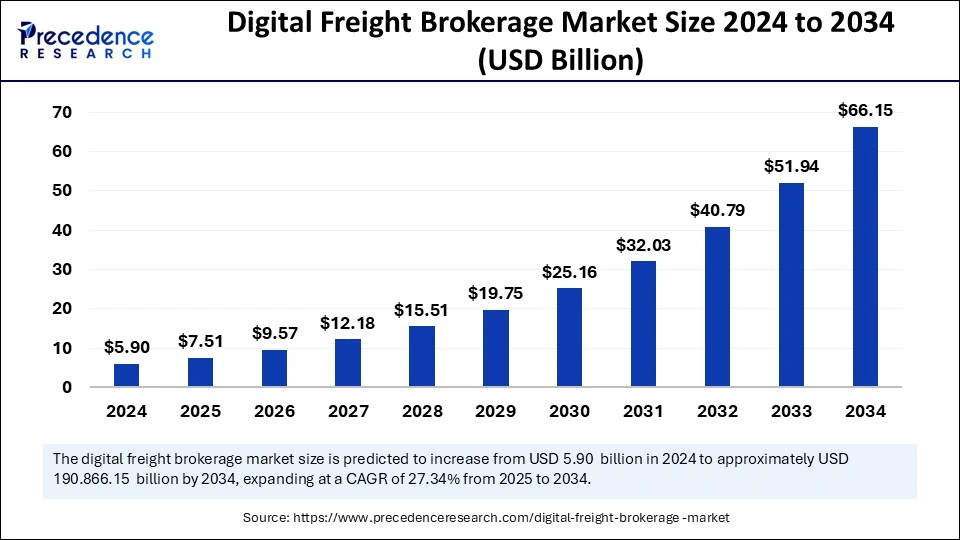

Digital freight brokerage market was valued USD 5.9 billion in 2024, projected to reach USD 66.15 billion by 2034, expanding at a remarkable 27.34% CAGR from 2025 to 2034.

Digital Freight Brokerage Market Key Takeaways

- North America dominated the global market with the largest market share around 43% in 2024.

- Asia Pacific is expected to witness the fastest growth during the forecast period.

- By transportation mode, the road freight segment captured the more than 75% market share in 2024.

- By transportation mode, the air freight segment is expected to grow at the fastest CAGR between 2025 and 2034.

- By service type, the full-truckload (FTL) brokerage segment accounted for a considerable share in 2024.

- By service type, the refrigerated freight (temp-controlled) segment is anticipated to expand at significant CAGR over the studied years.

- By customer type, the business-to-business (B2B) segment held the biggest market share in 2024.

- By customer type, the business-to-consumer (B2C) segment is projected to expand rapidly in the coming years.

- By end-user, the retail and e-commerce segment dominated the market in 2024.

- By end-user, the healthcare and pharmaceutical segment is expected to grow at a significant CAGR during the projection period.

Market Overview

The digital freight brokerage market is rapidly transforming the logistics and transportation industry through automation, real-time visibility, and data-driven decision-making. Digital freight brokers are utilizing advanced software platforms that automate the traditionally manual process of connecting shippers with carriers. These platforms replace outdated phone calls and emails with seamless interfaces and real-time data exchanges, enabling faster and more efficient load matching. As the logistics industry becomes increasingly complex, the adoption of digital solutions is essential to meet customer expectations for speed, transparency, and cost-efficiency.

The growing demand for flexible and resilient supply chains is pushing stakeholders to embrace the digital freight brokerage market, making it a vital part of the modern freight ecosystem.

Driven by technological advancements and the surge in e-commerce activities, the digital freight brokerage market is set to redefine logistics across the globe. Its core benefit lies in creating an optimized freight movement network that reduces empty miles, lowers shipping costs, and improves carrier utilization. Companies in this market offer services including freight quoting, shipment tracking, route optimization, and documentation through digital platforms.

The integration of artificial intelligence, machine learning, and blockchain into freight operations has become a game-changer, allowing digital freight brokers to deliver end-to-end visibility and predictive analytics. As more logistics firms look to future-proof their operations, the digital freight brokerage market is well-positioned for continued expansion.

Drivers

Several key factors are propelling the growth of the digital freight brokerage market, beginning with the rise of e-commerce and the growing need for agile shipping solutions. With online retail booming and consumers expecting faster delivery times, shippers are turning to digital platforms for greater flexibility and real-time capacity access. Traditional brokerage models lack the speed and responsiveness required in today’s market, giving digital platforms a competitive edge.

Another significant driver is the inefficiency in traditional freight operations. Manual methods are often slow, error-prone, and lack visibility. The digital freight brokerage market addresses these issues with automated solutions that minimize human error and streamline logistics workflows. Digital platforms help reduce overhead costs and eliminate redundant processes, which appeals to cost-conscious businesses looking for streamlined freight management.

The increased adoption of technology in transportation and logistics also fuels the digital freight brokerage market. As carriers and shippers digitize their operations, they demand integrated platforms that can provide instant quotes, track shipments in real time, and automate billing and compliance processes. Furthermore, the growing emphasis on data analytics and supply chain optimization is prompting businesses to adopt platforms that offer actionable insights and intelligent load matching.

Opportunities

The digital freight brokerage market presents a range of exciting opportunities for innovation and expansion. One major area is the development of AI-powered predictive analytics, which allows brokers to forecast shipping demands, optimize pricing, and preempt delivery issues. These capabilities not only enhance operational efficiency but also improve customer satisfaction through accurate and timely delivery.

Sustainability initiatives are opening new avenues within the digital freight brokerage market. As companies strive to reduce their environmental footprint, digital brokers can provide tools to calculate and lower emissions by minimizing empty miles and selecting the most fuel-efficient routes. With increasing regulatory pressures and consumer awareness around sustainability, digital freight brokers who offer green logistics solutions stand to gain a significant competitive advantage.

Cross-border shipping and international freight represent another opportunity for the digital freight brokerage market. Global trade is expanding, and businesses require platforms that can manage customs documentation, international regulations, and multi-modal logistics. By offering end-to-end digital solutions, brokers can tap into the growing demand for seamless international freight services. Additionally, small and mid-sized enterprises, which were previously underserved by traditional brokers, are increasingly adopting digital platforms to manage their shipping needs, broadening the market’s reach.

Challenges

Despite its promising growth trajectory, the digital freight brokerage market is not without its challenges. One of the most significant hurdles is the fragmented nature of the logistics industry. Many carriers still operate with outdated systems or limited digital capabilities, making integration with advanced digital platforms difficult. Ensuring seamless connectivity between diverse systems requires significant technological investment and coordination.

Another challenge is the intense competition in the digital freight brokerage market. Numerous startups and established players are vying for market share, leading to margin compression and frequent innovation cycles. To stay ahead, companies must continuously enhance their platforms, expand service offerings, and improve customer experience. This requires sustained investment in research, development, and talent acquisition, which can be a barrier for smaller firms.

Data privacy and cybersecurity are also major concerns in the digital freight brokerage market. With sensitive shipping data and financial information being transmitted and stored digitally, platforms become attractive targets for cybercriminals. A data breach could result in significant financial losses and reputational damage, making robust cybersecurity frameworks essential. Moreover, regulatory compliance, especially in the context of international shipments, adds another layer of complexity for digital freight platforms to navigate.

Regional Insights

The digital freight brokerage market exhibits strong regional variability, with North America holding a dominant position due to its mature logistics infrastructure and early adoption of digital solutions. The United States, in particular, is home to several leading digital freight platforms, supported by advanced technology ecosystems and a high concentration of shippers and carriers. Companies in this region are increasingly investing in digital tools to enhance supply chain visibility and performance, driving continued growth.

Europe is another key region in the digital freight brokerage market, characterized by strong regulatory frameworks and a focus on sustainability. Countries like Germany, the UK, and the Netherlands are at the forefront of digital logistics adoption. With the European Union promoting green transportation and data-driven logistics, digital freight brokers in the region are aligning their services with regional compliance requirements and sustainability goals.

Asia-Pacific represents the fastest-growing region in the digital freight brokerage market, driven by rapid urbanization, booming e-commerce, and infrastructure development. China and India are emerging as major hubs, with local startups offering tailored digital freight solutions to meet regional demands. Governments in the region are also investing in smart logistics networks and digital infrastructure, laying the groundwork for long-term growth.

Latin America and the Middle East are gradually adopting digital freight brokerage solutions, although market penetration remains lower compared to more developed regions. However, growing internet access and regional trade agreements are fostering demand for digital logistics services. As businesses in these regions seek greater efficiency and scalability, the digital freight brokerage market is poised for expansion.

Recent Developments

Recent developments in the digital freight brokerage market reflect a dynamic and rapidly evolving industry landscape. One notable trend is the integration of blockchain technology to enhance transparency and trust in freight transactions. Blockchain enables immutable records of shipments and smart contracts, reducing fraud and improving compliance. This technology is especially valuable for international freight, where documentation and trust between parties are critical.

Artificial intelligence and machine learning continue to be at the forefront of innovation in the digital freight brokerage market. AI-driven platforms can analyze historical data to optimize pricing, identify the best carrier options, and predict transit delays. These capabilities are helping brokers deliver superior customer service and reduce operational inefficiencies.

Mergers and acquisitions are also shaping the digital freight brokerage market. Larger logistics firms are acquiring digital startups to enhance their technological capabilities and expand their market reach. These strategic moves are creating more comprehensive service offerings that combine traditional freight expertise with cutting-edge technology.

In response to customer demands for real-time information, digital freight platforms are enhancing mobile apps and dashboards with advanced tracking, alerts, and communication tools. These updates allow shippers and carriers to manage shipments more effectively and respond quickly to disruptions. Additionally, many platforms are adding features that support sustainability tracking, enabling businesses to measure their carbon footprint and implement greener practices.

Digital Freight Brokerage Market Companies

- C.H. Robinson Worldwide, Inc.

- Coyote Logistics, LLC (a subsidiary of RXO, Inc.)

- Echo Global Logistics, Inc.

- J.B. Hunt Transport Services, Inc.

- Landstar System Holdings, Inc.

- Mode Global

- Schneider National, Inc.

- Total Quality Logistics, LLC

- Uber Freight (a subsidiary of Uber Technologies, Inc.)

- WWEX Group

Segments Covered in the Report

By Transportation Mode

- Air Freight

- Road Freight

- Rail Freight

- Ocean Freight

By Service Type

- Less-than Truckload (LTL) Brokerage

- Full-truckload (FTL) Brokerage

- Intermodal Brokerage

- Expedited Freight

- Cross-border Freight Brokerage

- Refrigerated Freight (Temp-controlled)

- Others

By Customer Type

- Business-to-Consumer (B2C)

- Business-to-Business (B2B)

By End-user

- Manufacturing

- Automotive

- Retail & E-commerce

- Food & Beverages

- Oil & Gas

- Healthcare & Pharmaceutical

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Ready for more? Dive into the full experience on our website!