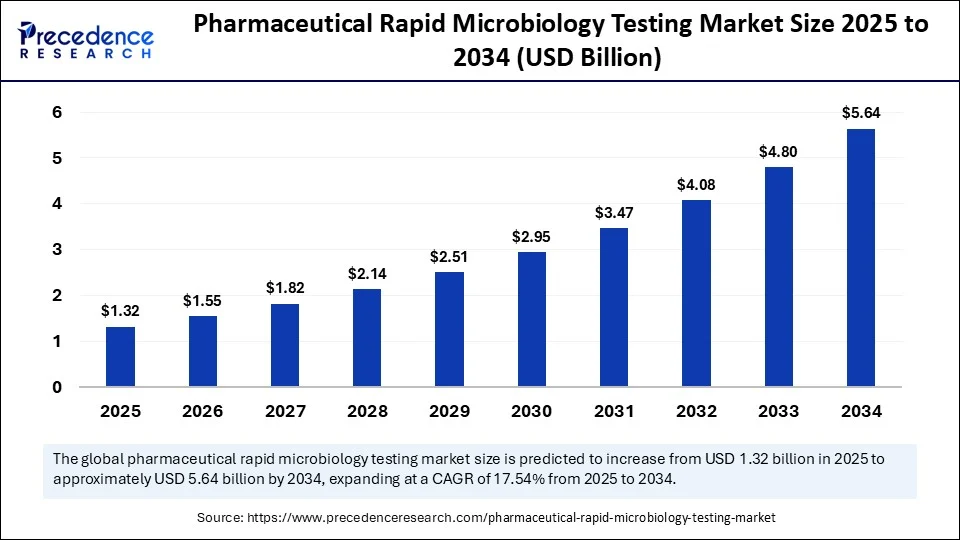

Pharmaceutical rapid microbiology testing market to reach USD 5.64 billion by 2034, growing at 17.54% CAGR from USD 1.12 billion in 2024.

Pharmaceutical Rapid Microbiology Testing Market Key Takeaways

- The market was valued at USD 1.12 billion in 2024, projected to reach USD 5.64 billion by 2034, growing at a CAGR of 17.54%.

- North America led the global market in 2024 with a 38% share, while Asia Pacific is poised to grow the fastest.

- PCR technology held the largest share, and flow cytometry is the fastest-growing tech segment.

- Instruments dominated by product type, whereas software & services will see the highest growth.

- Biopharmaceuticals led in applications; vaccines are the fastest-rising application.

- Bacteria were the most tested microorganisms, but viruses are projected to grow fastest.

- Pharma & biotech firms led end-user share; CMOs are expected to grow at the fastest pace.

- Sterility testing held the top spot in testing types, with environmental monitoring gaining momentum.

How is Artificial Intelligence Enhancing the Efficiency of Pharmaceutical Rapid Microbiology Testing?

Artificial intelligence is transforming pharmaceutical rapid microbiology testing by boosting data precision, shortening turnaround times, and supporting real-time decisions. AI algorithms efficiently detect microbial contaminants, minimizing false results and improving quality control. Integrated with automation, AI streamlines tasks like sample handling and colony counting. Predictive analytics further enhance safety by identifying potential contamination risks before they impact production.

As regulatory compliance tightens and biologics production grows, AI-driven RMT tools are becoming essential. With rising global demand for cost-effective and high-quality testing, the market is set to expand steadily.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/6332

Market Overview

The pharmaceutical rapid microbiology testing market is experiencing robust growth, driven by increasing regulatory pressure, rising contamination concerns, and advancements in microbiological diagnostics. Traditional microbiology methods are gradually being replaced with rapid technologies that provide faster, more accurate results. These tools are becoming integral to pharmaceutical manufacturing processes as they enhance real-time contamination monitoring and ensure batch safety. The shift towards automation and digitization within pharmaceutical labs is further supporting market expansion.

Drivers

The demand for efficient, time-saving, and compliant microbiological testing methods is a primary growth driver for the pharmaceutical rapid microbiology testing market. Stringent regulatory frameworks imposed by global health agencies such as the FDA and EMA are compelling pharmaceutical companies to adopt rapid solutions. Additionally, the rise in production of biologics and sterile drugs has necessitated more precise and faster microbial testing. Integration of artificial intelligence, machine learning, and real-time data monitoring systems into testing platforms has further accelerated industry adoption.

Opportunities

Growing investments in pharmaceutical R&D and increasing drug approvals offer significant opportunities for the market. Emerging economies are expanding their pharmaceutical infrastructure, paving the way for increased adoption of rapid testing systems. The growing trend of outsourcing testing services to contract manufacturing organizations (CMOs) is another potential growth area. Advancements in biosensor technology and microfluidics also open up new avenues for innovation in microbial detection and quantification.

Challenges

Despite the evident benefits, the high initial cost of implementing rapid microbiology systems remains a major hurdle. Many small and mid-sized pharmaceutical firms still rely on traditional methods due to budget constraints. Moreover, validation complexities and regulatory approval requirements for newer technologies can delay adoption. The need for skilled professionals to operate advanced testing systems also presents a gap in the workforce.

Regional Insights

North America currently dominates the pharmaceutical rapid microbiology testing market, supported by a well-established pharmaceutical industry and stringent regulatory mandates. Europe follows closely with strong focus on pharmaceutical quality control and increasing adoption of advanced laboratory automation. The Asia Pacific region is emerging as the fastest-growing market, fueled by increased pharmaceutical manufacturing activities, supportive government policies, and rising demand for generic drugs. Countries like China and India are investing heavily in expanding their pharmaceutical quality infrastructure.

Pharmaceutical Rapid Microbiology Testing Market Companies

- Thermo Fisher Scientific Inc.

- Merck KGaA (MilliporeSigma)

- Bio-Rad Laboratories, Inc.

- Lonza Group AG

- Charles River Laboratories International, Inc.

- 3M Company

- Hamilton Company

- Microbiological Solutions (a part of Pall Corporation)

- Pall Corporation

- Pall Life Sciences

- Qiagen N.V.

- PerkinElmer, Inc.

- Eurofins Scientific

- IDEXX Laboratories, Inc.

- BioMérieux SA

- Neogen Corporation

- Agilent Technologies, Inc.

- Nova Biomedical Corporation

- LuminUltra Technologies Ltd.

- Accelerate Diagnostics, Inc.

Recent Developments

Recent years have witnessed significant collaborations between pharmaceutical companies and diagnostic technology providers. Companies are introducing AI-driven platforms that automate colony counting, environmental monitoring, and contamination detection. Key market players have also expanded their rapid testing portfolios through mergers and acquisitions. Innovations such as point-of-care microbiology testing kits and cloud-integrated lab information systems are reshaping the market landscape.

- On March 4, 2025, Nelson Labs launched its rapid sterility testing at three sites (Salt Lake City and Itasca, U.S., and Wiesbaden, Germany), reducing incubation times from 14 days to as little as 6 days while maintaining USP <71> compliance.

- On April 22, 2025, Redberry successfully validated a 4-day rapid sterility test for pharmaceutical products, reducing the usual 14-day compendial release time while still ensuring compliance and microbial identification.

- On January 16, 2025, Rapid Infection Diagnostics Inc. (RID) launched its BSIDx system for bloodstream infections, delivering pathogen identification and antibiotic sensitivity testing in under 5 hours, approximately 30 hours faster than conventional methods.

Segments Covered in the Report

By Technology Type

- Polymerase Chain Reaction (PCR)

- ATP Bioluminescence

- Flow Cytometry

- Enzyme-Linked Immunosorbent Assay (ELISA)

- Chromatography

- Biosensors & Bioassays

- Impedance Microbiology

- Others (e.g., Microfluidics, Microarray)

By Product Type

- Instruments

- Reagents & Consumables

- Software & Services

By Application

- Biopharmaceuticals

- Small Molecule Pharmaceuticals

- Vaccines

- Contract Research Organizations (CROs)

- Academic & Research Institutes

By Microorganism Type Tested

- Bacteria

- Fungi (Yeast and Mold)

- Viruses

- Mycoplasma

- Endotoxins

By End User

- Pharmaceutical & Biotechnology Companies

- Contract Manufacturing Organizations (CMOs)

- Hospitals & Diagnostic Laboratories

- Research & Academic Institutes

By Testing Type

- Sterility Testing

- Environmental Monitoring

- Bioburden Testing

- Raw Material Testing

- Water Testing

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Ready for more? Dive into the full experience on our website!