Pumped Hydro Storage Market Key Takeaways

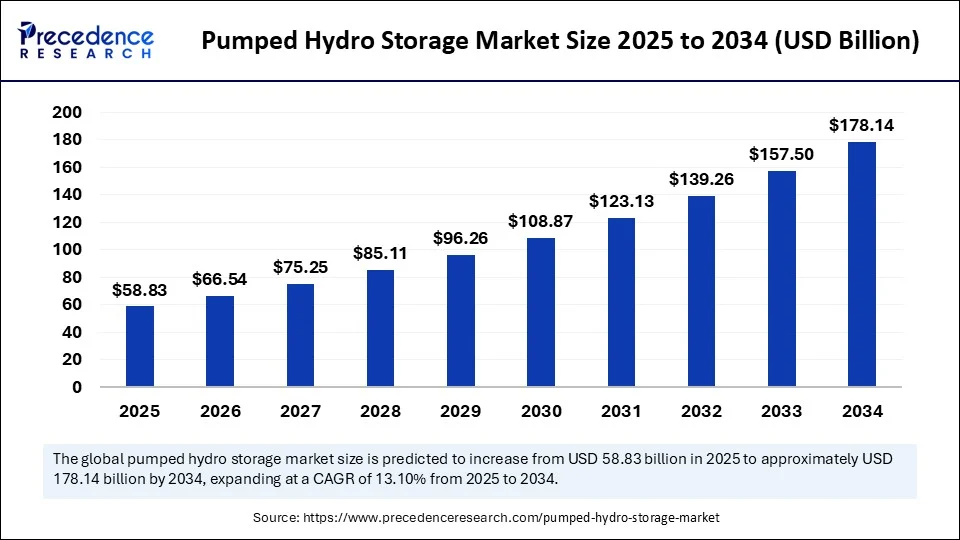

- The global pumped hydro storage market stood at USD 52.01 billion in revenue in 2024.

- It is anticipated to hit USD 178.14 billion by 2034, reflecting substantial market growth.

- From 2025 to 2034, the market is expected to expand at a compound annual growth rate (CAGR) of 13.10%.

- Europe maintained its dominance in 2024, accounting for the largest share of 59% in the market.

- The Asia Pacific region is poised to register the fastest CAGR over the forecast period.

- North America continues to be a key player within the global market landscape.

- Among types, open-loop systems held the highest market share in 2024.

- The closed-loop systems category is anticipated to grow at the fastest CAGR through 2034.

- In terms of capacity, the above 1000 MW segment emerged as the market leader in 2024.

- The 500–1000 MW segment is projected to achieve the strongest CAGR in the years ahead.

How is Artificial Intelligence Transforming the Operations of Pumped Hydro Storage Systems?

Artificial Intelligence is revolutionizing the operations of pumped hydro storage systems by enabling smarter, more efficient, and predictive energy management. Through advanced algorithms and machine learning models, AI optimizes water flow, turbine speed, and energy dispatch based on real-time grid demand and weather forecasts. AI also enhances predictive maintenance by analyzing sensor data to detect early signs of wear and tear, reducing downtime and extending equipment life.

Market Overview

The pumped hydro storage market is regaining prominence as the world moves toward decarbonized and resilient power systems. Serving as both a storage mechanism and a grid-balancing tool, pumped hydro facilitates the smooth integration of renewables into national energy mixes. With increasing pressure to reduce greenhouse gas emissions, energy storage has become central to climate strategies, and pumped hydro offers a proven, cost-effective solution. The pumped hydro storage market benefits from its longevity, minimal operational emissions, and ability to support grid frequency and voltage stability, making it essential to future energy plans.

Drivers

Global climate action initiatives and the retirement of fossil-fuel-based plants are major drivers behind the pumped hydro storage market. Governments are increasingly mandating renewable energy adoption, and the variability of these sources necessitates stable storage infrastructure. In addition, rising electricity demand, aging infrastructure, and the need for energy reliability are prompting grid operators to invest in pumped hydro. Technological improvements have enhanced the efficiency and responsiveness of these systems, further strengthening their role in modern power grids and solidifying the market’s growth.

Opportunities

The pumped hydro storage market holds vast potential in both mature and emerging markets. Many countries are exploring the conversion of old mines and abandoned quarries into underground pumped hydro facilities. The development of closed-loop systems not connected to natural bodies of water provides flexibility in location, enabling installations closer to demand centers. As funding for green infrastructure projects increases, new partnerships between government entities, utilities, and private investors are forming, generating momentum for expansion. These developments present a valuable growth trajectory for the pumped hydro storage market.

Challenges

Barriers to growth in the pumped hydro storage market include the lengthy permitting process and opposition from environmental groups. Hydrological dependencies and seismic considerations must be carefully evaluated before project approval, which can delay development. Another hurdle is the lack of streamlined regulatory frameworks in some countries, which can discourage investment. The capital-intensive nature of pumped hydro projects also presents financing challenges, especially in markets with limited access to infrastructure funds. Addressing these challenges will require collaboration across public and private sectors to streamline development and maximize benefits.

Regional Insights

Europe dominated the pumped hydro storage market in 2024 with a commanding 59% share, driven by established hydroelectric infrastructure and environmental policy support. Asia Pacific is forecasted to grow at the fastest CAGR between 2025 and 2034, fueled by rapid industrialization, energy demand, and clean energy initiatives in countries such as China, India, and Australia. North America remains a key region, with efforts underway to retrofit existing plants and integrate pumped hydro into resilient energy networks. The regional dynamics indicate widespread recognition of the pumped hydro storage market’s strategic importance.

Pumped Hydro Storage Market Companies

- ANDRITZ AG (Austria)

- Siemens AG (Germany)

- Enel SpA (Italy)

- Duke Energy Co. (U.S.)

- Voith GmbH & Co. KGaA (Germany)

- GE Vernova (U.S.)

- Power Construction Corporation of China (China)

- Torrent Power (India)

- ITC Holdings (U.S.)

- NextEra Energy, Inc. (U.S.)

- China Energy Engineering Corporation (China)

Recent Developments

- In May 2025, AGL acquired 100% ownership of two pumped hydro energy storage projects held by Upper Hunter Hydro Top Trust and its trustee (UHH). The two early-stage projects are located in the Hunter region, NSW. The projects at Glenbawn and Glennies Creek aim to provide 770 MW 10-hour and 623 MW 10-hour pumped hydro energy storage capacity respectively with the future opportunity for integrated wind farms.

- In April 2025, the Scottish Government approved UK’s pumped storage hydro project at Loch Earba. This will be the largest pumped hydro storage project, which will have 1800 MW installed energy production capacity and 40,000 MWh storage capacity, surpassing the currently existing storage capacity.

- In March 2025, the Madhya Pradesh, India, government launched a scheme for the development and implementation of pump hydro storage projects in the state in an attempt to tackle the surplus energy available in the state.

- In March 2025, SSE and Gilkes Energy submitted a Section 36 planning consent application to Scottish Government for a proposed joint venture Fearna pumped storage hydro (PSH) project in Scotland’s Highlands. The 50:50 development joint venture project is located at the western end of Glengarry, around 25km west of Invergarry and adjoins SSE Renewables’ existing Loch Quoich reservoir in the Great Glen hydro scheme. Under the terms of the joint venture agreement, Gilkes Energy will lead the project’s development under a developer services agreement with SSE Renewables.

- In January 2025, the provincial government of Ontario, Canada, commenced the pre-development work on a pumped hydro energy storage project, which have a storage capacity of 1G/11GW. Ontario will invest up to CA$285 million (US$198 million) to advance the Ontario Pumped Storage Project, proposed for construction in Meaford, a coastal municipality about 180km from Toronto.

Segments Covered in the Report

By Type

- Open Loop

- Closed Loop

- By Capacity

By Capacity

- Below 500 MW

- 500-1000 MW

- Above 1000 MW

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Get Report Sample Link @ https://www.precedenceresearch.com/sample/6295