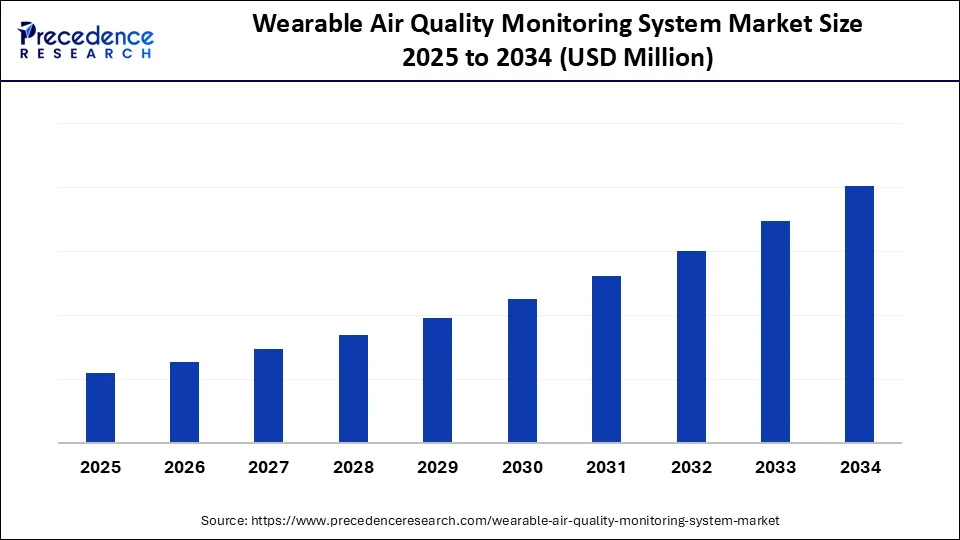

The wearable air quality monitoring system market advances with smart wearables, air sensor innovation, and rising concerns about indoor outdoor pollution levels

Wearable Air Quality Monitoring System Market Key Takeaways

- In 2024, North America led the market in terms of share.

- Asia Pacific is set to grow the fastest between 2025 and 2034.

- Among pollutants, particulate matter (PM) topped the list, especially the PM2.5 sub-segment in 2024.

- VOCs are expected to grow at a strong pace during the forecast period.

- Electrochemical sensors were the most widely adopted technology in 2024.

- Hybrid sensor systems are likely to grow significantly over the next decade.

- Clip-on devices held the largest share by form factor in 2024.

- Smart clothing is projected to be the fastest-growing form factor through 2034.

- Bluetooth was the leading connectivity solution in 2024.

- Cellular (LTE/NB-IoT) is predicted to see robust growth moving forward.

- Personal/consumer health monitoring led the applications in 2024.

- The industrial worker safety segment is poised for rapid expansion.

- Consumers were the dominant end users in 2024.

- Occupational safety agencies are expected to grow rapidly in the coming years.

- Online retail was the top distribution method in 2024.

- B2B sales & contracts will likely witness the fastest growth over the forecast period.

How is AI Altering the Wearable Air Quality Monitoring System Market?

AI is changing how we monitor and manage air quality. By analyzing massive amounts of sensor data, machine learning algorithms can spot pollution patterns, predict future problems, and trace pollution back to its source. AI also looks at personal data to offer helpful advice—like suggesting cleaner walking routes or times to exercise. This makes it easier for people to stay healthy and for officials to take action when needed. With AI, we can create better air quality strategies, deliver early warnings, and offer health tips tailored to individuals.

Get Sample Link @https://www.precedenceresearch.com/sample/6409

Market Overview

The wearable air quality monitoring system market, particularly in the consumer and smart-home space, has seen robust growth over the past few years. Devices range from clip-on badges and wristbands to pendants and smart rings, all aimed at tracking pollutants like PM₂.₅, PM₁₀, CO₂, VOCs, and ozone. Growing concerns about urban pollution, indoor air toxins, and long-term health risks have spurred rising consumer interest.

North America and Europe currently account for the largest shares, attributed to higher disposable incomes and wellness-conscious populations. Meanwhile, the Asia-Pacific region is experiencing especially rapid uptake, driven by rising urban air pollution, public health concerns, and expanding middle-class demand.

Drivers

Primary drivers of this segment include heightened awareness of air pollution’s impact on health, post-pandemic focus on indoor air quality, and increasing demand for personal monitoring solutions. The COVID-19 pandemic intensified attention toward indoor air safety, leading consumers to measure ventilation quality and airborne particulates in homes and public spaces. Another potent driver is the growing prevalence of smart-home ecosystems; many consumers now expect connectivity between devices like air purifiers, HVAC systems, and health wearables.

Advances in miniaturized sensor technology—enabling compact, multipollutant-capable devices with reasonable battery life—have reduced barriers to adoption. Finally, the availability of AI-powered insights and exposure coaching within companion smartphone apps has significantly boosted user engagement, making these devices feel more like personalized wellness tools rather than raw sensors.

Opportunities

The consumer segment presents numerous opportunity areas. Firstly, there is strong potential in expanding into schools, senior care facilities, and family wellness programs where continuous air quality monitoring can help vulnerable populations. Partnerships with air purifier and smart HVAC manufacturers promise synergy, enabling wearable-triggered automation (e.g., purifiers activating when air quality drops below thresholds).

Beyond hardware, subscription-based models tied to health exposure tracking, allergen alerts, and personalized coaching create recurring revenue streams. Some startups are experimenting with gamification—rewarding users for low exposure days or clean-air habits—to improve long-term device usage and brand loyalty. Because emerging markets in Asia and Latin America face severe pollution and have growing smartphone adoption, affordable yet accurate wearable devices could spark vast new user bases in cost-sensitive demographics.

Challenges

Several challenges confront consumer wearable AQ devices. Accuracy and reliability remain critical issues: consumer-tier sensors can drift over time, vary between units, and sometimes yield inconsistent results. Without established calibration standards or third-party validation, consumer trust remains fragile. High device cost—especially for multipollutant monitors with cloud connectivity and AI features—limits adoption among price-conscious users.

Data privacy and security also pose concerns; exposure data can be sensitive, potentially revealing location, health habits, or patterns. Users may be reluctant to share or store data without robust policies in place. Competition is fierce: many startups and established electronics brands now offer devices in this space, making differentiation through design, accuracy, and brand credibility increasingly difficult.

Recent Developments

In the past year, several consumer-grade wearable AQ devices launched with breakthroughs in form factor and usability—ring-shaped monitors, pendant-style wearables, and hybrid devices that clip to a bag or backpack. These new designs emphasize wearability and aesthetic appeal as much as sensor capability. Many devices now support multi-channel pollutant detection (PM₂.₅, VOCs, CO₂) with companion smartphone apps offering AI-driven health tips and alerts. A handful of brands have introduced integration with smart-home platforms: when pollution levels rise, air purifiers or ventilation systems automatically activate.

On the research side, federated learning models are being piloted to enable collective AI training across devices—so sensors learn and improve without centralizing personal data. Edge-AI modules embedded in wearables now allow real-time pollutant recognition with minimal latency and power use. Consumer focus groups and pilot programs increasingly show that users respond favorably to gamified features: “clean-air streaks” and daily exposure scoring help improve device retention. Finally, transparency and calibration have become points of differentiation—some brands now offer annual recalibration services or partnerships with accredited labs to enhance trust.

Wearable Air Quality Monitoring System Market Companies

- Atmotube (Plume Labs – part of AccuWeather)

- Kaiterra

- TZOA (now part of Awair)

- Aeroqual Ltd.

- Clarity Movement Co.

- Qingping Technology

- Temtop (Elitech Technology, Inc.)

- uHoo

- Sensirion AG

- RAE Systems (a Honeywell company)

- Flow by Plume Labs

- Wavelet Health

- Amphenol Advanced Sensors

- AirBeam (HabitatMap)

- Purelogic Labs India

- Prana Air

- Airveda

- Bosch Sensortec

- Breezometer (acquired by Google)

- Blueair (Unilever)

Segments Covered in the Report

By Pollutant Type Monitored

- Particulate Matter (PM1.0, PM2.5, PM10)

- Volatile Organic Compounds (VOCs)

- Nitrogen Dioxide (NOâ‚‚)

- Carbon Monoxide (CO)

- Ozone (O₃)

- Carbon Dioxide (COâ‚‚)

- Temperature & Humidity Sensors

By Technology

- Electrochemical Sensors

- Optical Particle Counters

- Metal Oxide Semiconductor (MOS) Sensors

- NDIR (Non-Dispersive Infrared) Sensors

- Hybrid Sensor Systems

By Form Factor

- Wristbands

- Clip-on Devices

- Smart Clothing

- Lanyard/Brooch Form

- Helmet/Head-Mounted Devices

By Connectivity

- Bluetooth

- Wi-Fi

- Cellular (LTE/NB-IoT)

- Offline/USB Data Transfer

By Application

- Personal/Consumer Health Monitoring

- Industrial Worker Safety

- Outdoor Activity & Fitness Monitoring

- Healthcare Monitoring (Asthma, COPD)

- Academic & Field Research

By End User

- Consumers

- Occupational Safety Agencies

- Research Institutions

- Healthcare Providers

- Environmental Monitoring Agencies

By Distribution Channel

- Online Retail (DTC platforms, eCommerce)

- Offline Retail (Electronics/Medical Stores)

- B2B Sales & Contracts

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Also Visit@ https://www.precedenceresearch.com