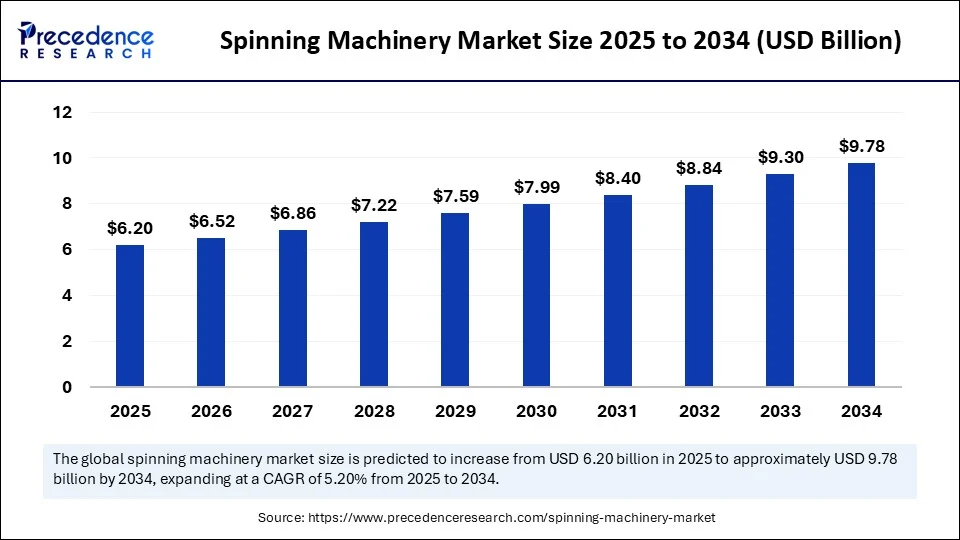

The global spinning machinery market size is valued to reach around USD 9 78 billion by 2034 increasing from USD 5 89 billion in 2024, with a CAGR of 5 20

Spinning Machinery Market Key Takeaways

- The spinning machinery market was worth USD 5.89 billion in 2024 and is projected to grow to USD 9.78 billion by 2034.

- It is expected to grow at a steady CAGR of 5.20% from 2025 to 2034.

- Asia Pacific had the largest share in 2024 and is expected to keep growing.

- Among machine types, ring spinning machines were the most in-demand in 2024.

- Air-jet spinning machines are expected to grow the fastest during the forecast period.

- Automatic machines held the largest share by operation type in 2024 and are set to lead in the coming years.

- Natural fibers were the most widely used material type in 2024.

- Blended fibers are likely to grow at the highest CAGR moving forward.

- The apparel & fashion industry accounted for the biggest market segment in 2024.

- The industrial textiles sector is projected to grow the fastest through 2034.

- Short staple spinning led the spinning processes in 2024.

- Long staple spinning is forecasted to grow at the fastest rate.

- Direct sales was the dominant sales channel in 2024.

- Online sales are expected to expand the most between 2025 and 2034.

How is AI Transforming the Spinning Machinery Market?

Advanced technologies like AI and IoT are bringing major improvements to the spinning and textile industry. They help produce better-quality yarn and fabric, improve pattern and color management, and streamline supply chains. AI systems can automate everything from handling fibers to checking quality, while also spotting equipment issues before they happen—cutting down on delays and repairs.

For designers, AI makes it easier to create attractive patterns using tools like 3D fabric modeling. It also ensures fair and accurate fabric grading. With the help of AI, yarn properties such as fineness and strength can now be measured with incredible accuracy. These tools are opening new possibilities across the textile industry, with even more potential still to be explored.

Get Sample Link@ https://www.precedenceresearch.com/sample/6411

Market Overview

Seen through the lens of innovation and cutting‑edge technology, the spinning machinery market is undergoing a digital transformation. While conventional ring and rotor systems remain foundational, new platforms integrating artificial intelligence, advanced sensors, and robotics are emerging.

The modern spinning plant increasingly resembles a connected factory: machines equipped with in‑line quality analyzers, automated doffing robots, and cloud‑based control platforms that allow remote monitoring, cross‑line yield tracking, and automatic anomaly detection. Virtual simulations and digital twins are being used to optimize machine settings before deployment, reducing trial‑and‑error commissioning. Overall global machine demand is rising steadily as mill operators seek higher productivity, improved yarn consistency, and reduced labor costs.

Drivers

Key enablers of this trend include continuous pressure on throughput and quality in a low‑margin industry, making even small efficiency gains vital. Labor cost escalation in certain textile hubs coupled with labor shortages is pushing mills to invest in automation. Rising demand from fast‑fashion and high‑value technical textiles—where quality and lot‑to‑lot consistency are paramount—expands demand for precision spinning systems.

Data‑driven operational optimization—based on metrics like end‑breakdown frequency and yarn evenness—has created space for smart machines that continually adjust torque, tension, and speed. Capital availability through leasing platforms and equipment‑as‑a‑service models lowers barriers for innovation adoption. Sustainability regulations and corporate ESG mandates further motivate investment in machines that deliver improved energy profiles and lower scrap rates.

Opportunities

Technology providers can tap into recurring revenue through software, analytics, and predictive‑maintenance services linked to machinery. Demand for retrofit and upgrade kits that add intelligence or connectivity to legacy machines is rising. Another opportunity lies in smart mills built for niche or high‑margin production—technical textiles, high‑performance yarns for automotive and medical fabrics, etc.—where precision is critical. Vendors can also explore machine‑as‑a‑service offerings, spreading the investment cost across operational budgets.

A growing perimeter exists for regional offices supporting service and analytics in emerging textile regions. There’s also opportunity in cross‑industry integration, such as providing solutions that feed yarn quality data into apparel supply‑chain traceability platforms or carbon footprint tracking systems.

Challenges

However, technological complexity introduces new hurdles. Deployment of AI and sensors often requires expertise many mills lack, making buyer education and training essential. Data security and IP protection concerns surface when connecting machinery to cloud platforms—mills worry about exposing operational secrets or vendor dependencies.

Upfront costs remain significant, even with leasing models—particularly for smaller factories. Legacy‑line integration can be difficult; different vendors, protocols, and control platforms reduce interoperability. Regulatory standards for AI‑powered industrial equipment are still emerging in many regions, introducing uncertainty. There’s also risk around over‑promising features: if predictive‑maintenance algorithms fail to deliver clear value, customer trust could erode.

Recent Developments

Recent developments in this slice of the market include the commercialization of spinning machines featuring built‑in AI engines that monitor fiber feed tension, spindle vibration, and yarn evenness in real time—making adjustments during operation rather than post‑shift. Some providers now supply digital twins allowing mills to simulate line performance under different parameters, significantly reducing commissioning time. Retrofit kits with sensor arrays and cloud connectivity are being marketed as a lower‑cost way to bring automation to older plants.

Additionally, equipment‑as‑a‑service models are being piloted, where mills pay monthly usage fees instead of upfront capital. Several cross‑industry case studies show how data from spinning machines can feed into broader supply‑chain dashboards—tracking CO₂ per kg of yarn, water usage, and energy consumption. Energy‑efficient systems—such as electronically commutated motors, optimized airflow in open‑end machines, and heat recovery options—are becoming standard, enabling mills to reduce per‑unit energy consumption by up to 15%.

Spinning Machinery Market Companies

- Rieter Holding AG

- Saurer Intelligent Technology AG

- Lakshmi Machine Works Ltd. (LMW)

- Truetzschler Group

- Marzoli Machines Textile S.r.l.

- Toyota Industries Corporation

- Murata Machinery Ltd. (Muratec)

- Savio Machine Tessili S.p.A.

- Jingwei Textile Machinery Co., Ltd.

- Zhejiang Tatian Co., Ltd.

- Jiangsu Jinlong Machinery

- Electro-Jet S.A.

- SSM Scharer Schweitzer Mettler AG

- Perfect Equipements

- A.T.E. Enterprises

- Veejay Lakshmi Engineering Works Ltd.

- TMT Machinery, Inc.

- Pacific Associates

- Bhagat Textile Engineers Pvt. Ltd.

- Zhejiang Rifa Textile Machinery Co., Ltd.

Segments Covered in the Report

By Machine Type

- Ring Spinning Machine

- Rotor Spinning Machine (Open-End Spinning)

- Air-Jet Spinning Machine

- Friction Spinning Machine

- Others (e.g., Vortex, Electrostatic)

By Operation Type

- Automatic

- Semi-Automatic

- Manual

By Material Type

- Natural Fibers (Cotton, Wool, etc.)

- Synthetic Fibers (Polyester, Nylon, etc.)

- Blended Fibers

By End-Use Industry

- Apparel & Fashion

- Home Textiles

- Industrial Textiles

- Medical Textiles

- Automotive Textiles

- Others

By Spinning Process

- Short Staple Spinning

- Long Staple Spinning

By Sales Channel

- Direct Sales

- Distributors & Dealers

- Online Channels

By Region

- Asia-Pacific

- Europe

- North America

- Latin America

- Middle East & Africa

Also Read @https://www.precedenceresearch.com