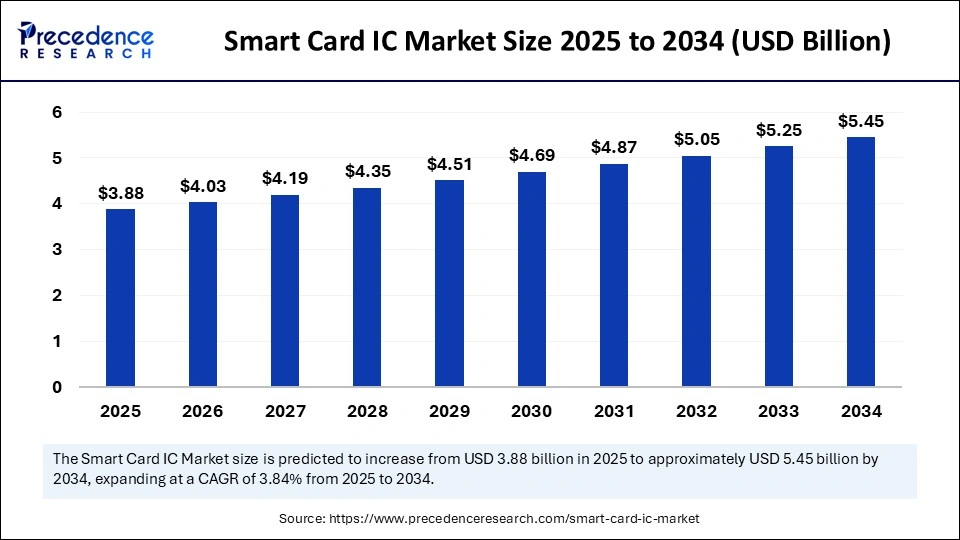

The global smart card IC market size is valued to reach around USD 5.45 billion by 2034 increasing from USD 3.74 billion in 2024, with a CAGR of 3.84%.

Smart Card IC Market Key Takeaways

- In terms of revenue, the smart card IC market is valued at $3.88 billion in 2025.

- It is projected to reach $5.45 billion by 2034.

- The market is expected to grow at a CAGR of 3.84% from 2025 to 2034.

- Asia Pacific dominated the global smart card IC market with the largest revenue share in 2024.

- North America is expected to grow at the fastest CAGR from 2025 to 2034.

- By type, the contactless segment held the major revenue share in 2024.

- By type, the contact segment is expected to grow at the highest CAGR during the projection period.

- By architecture, the 16-bit segment dominated the market in 2024.

- By architecture, the 32-bit segment is expected to expand at the fastest CAGR between 2025 and 2034.

- By configuration, the microprocessor-based cards segment contributed the biggest market revenue share in 2024.

- By configuration, the hybrid smart cards segment is expected to expand at a significant CAGR in the coming years.

- By application, the ID cards segment contributed the biggest revenue share in 2024.

- By end-user, the government segment dominated the market in 2024.

- By end-user, the healthcare segment is expected to grow at a significant CAGR over the projected period.

AI Impact on the Smart Card IC Market

-

Smart, secure chips: Smart card ICs use AI to enable encrypted authentication, fraud detection, and anomaly spotting directly on the chip.

-

Predictive reliability: Built‑in AI monitors performance and predicts faults ahead of time—boosting uptime and deployment efficiency.

-

Tailored user experience: AI personalization through in‑card biometrics or user‑specific authentication logic increases accuracy, flexibility, and overall user satisfaction.

Market Overview

The Smart Card IC Market is evolving beyond transaction chips into a broader identity and connectivity platform. Early applications in SIM cards and financial transactions remain dominant, but new use cases in e-governance, healthcare, enterprise access control, and IoT keep broadening the segment. Contactless smart card ICs represent the fastest‐growing interface type; microcontroller-based ICs provide onboard encryption, biometric support, and multi-application capability essential for modern security demands.

Drivers

-

Innovations in biometric payment cards and identity cards require ICs with embedded fingerprint sensors or secure biometric templates.

-

Contactless/NFC technology evolution is enabling tap-based fare payment, entry systems, loyalty programs and retail authentication.

-

Internet-of-Things use cases require chip-based identity modules embedded in sensors, wearables, vehicles, and meters.

-

Multi-application IC chips offering transaction, transit, ID, and loyalty stored credentials on the same card drive user convenience and program integration.

-

Standards development—ISO 14443, ISO 24727, GlobalPlatform secure element protocols—are enabling interoperable ecosystems for identity and authentication across industries.

Opportunities

-

Custom IC design for integrated biometric smart cards combining EMV payment, ID, and access credentials.

-

Embedded secure elements in wearable devices, e-health tokens, and e‑visas that use smart IC-based identity.

-

Blockchain and decentralized identity initiatives that rely on secure smart card IC storage for credential management.

-

Telecom partnerships embedding eSIM on card form factors for modular authentication and device provisioning.

-

Corporate adoption of multi‑purpose smart cards for ID, door access, and micropayments within enterprise ecosystems.

Challenges

-

R&D and fabrication cost of advanced biometric ICs and dual-technology chips can limit scalability to mass markets.

-

Security vulnerabilities: academic studies have demonstrated possible bypass and side‑channel attacks on blocking cards and EMV contactless protocols unless updated.

-

Reliability and longevity of secure ICs in multi-application environments demand rigorous testing and lifecycle management.

-

Competing identity paradigms, such as mobile device-based key exchange, may reduce physical card demand.

-

Regulatory and interoperability gaps across regional standards make global rollouts complex.

Recent Developments

-

Several IC vendors have launched chips combining microcontroller, NFC front-end, secure element, and biometric capabilities on a single low‑power chip.

-

Consortium-based standards frameworks are harmonizing management, lifecycle control, and app provisioning—making multi‑application smart cards easier to deploy.

-

Government programs have rolled out biometric national ID cards, e‑passports, and transit cards that leverage advanced IC features.

-

Financial issuers are launching dual‑interface biometric payment cards embedding fingerprint sensors, enabling contactless or contact-based authentication.

-

Research and development continue to upgrade EMV and contactless protocols to close known vulnerability gaps and strengthen card‑terminal security.

Smart Card IC Market Companies

- Infineon Technologies

- NXP Semiconductors

- STMicroelectronics

- Samsung Electronics

- IDEMIA

- Giesecke+Devrient

- Microchip Technology

- Texas Instruments

- Toshiba Corporation.

- Nations Technologies Inc.

Get Sample Link @ https://www.precedenceresearch.com/sample/6205

Segment Covered in the Report

By Type

- Contact

- Contactless

By Architecture

- 16-bit

- 32-bit

By Configuration

- Memory Cards

- Microprocessor-based Cards

- Dual-interface Cards

- Hybrid Smart Cards

By Application

- SIM Cards

- ID Cards

- Employee IDs

- Citizen IDs

- ePassports

- Driving Licenses

- Financial Cards

- IoT Devices

- Others

By End-user

- IT & Telecommunications

- BFSI

- Government

- Healthcare

- Transportation

- Retail

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Also Read @https://www.precedenceresearch.com