Auto Ventilated Seats Market Key Takeaways

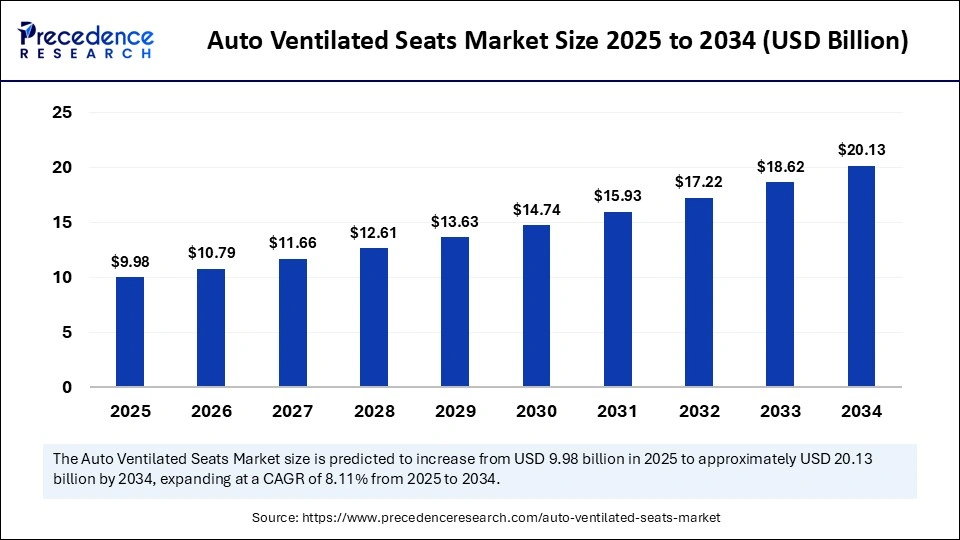

The auto ventilated seats market is projected to grow from $9.98 billion in 2025 to $20.13 billion by 2034, at a CAGR of 8.11%. North America led the market with the largest share in 2024, while Asia Pacific is set to grow at the fastest rate through 2034. Among vehicle types, luxury cars held the top revenue share in 2024, and mid-size cars are expected to grow significantly in the near future. By end-user, OEMs dominated in 2024, with the aftermarket segment forecasted to expand rapidly. Regarding fan type, the axial fan segment led the market in 2024, while the radial fan segment is expected to grow at the highest CAGR during the forecast period.

Impact of Artificial Intelligence on the Auto Ventilated Seats Market

Artificial intelligence (AI) is essential for advancing auto ventilated seat technology since it allows systems to act more wisely. Rather than letting passengers use basic manual features, AI-powered ventilated seats help control the air by reading temperature, humidity, and passenger choices. Adaptive systems add comfort for drivers during long trips or very cold or hot weather and save energy at the same time. Additionally, major automakers are introducing AI technology to help the seats handle user needs much better by studying the actions or surroundings of the driver.

Market Overview

The auto ventilated seats market has emerged as a crucial component of the automotive interior systems segment, especially as consumer demand for comfort and luxury continues to rise. These systems offer improved air circulation through seat perforations, which helps in maintaining thermal comfort by regulating heat and moisture. The growing trend toward premium features in vehicles, even in mid-range segments, is driving the expansion of the auto ventilated seats market globally.

Initially introduced as a luxury addition, ventilated seats have now become more mainstream, supported by rising living standards, urban mobility needs, and advanced HVAC integrations. The market’s growth is being reinforced by automotive manufacturers’ increasing focus on passenger wellness and ride quality, turning ventilated seating into a standard offering in various vehicle models.

Drivers

Several key factors are fueling growth in the auto ventilated seats market. Increasing global sales of luxury and high-end vehicles that prioritize passenger comfort and technological sophistication have created a strong foundation for ventilated seat adoption. In hot and humid regions, consumers are particularly drawn to the comfort and health benefits offered by these seats.

Rising awareness of in-cabin air quality, driver fatigue reduction, and posture-related health concerns are also contributing to the demand. Automakers are responding by offering multi-zone climate-controlled seating, which often includes ventilation as a core feature. Moreover, advancements in seat design, materials, and compact fan mechanisms have made it easier to integrate ventilated technology into more vehicle types, which is further supporting growth in the auto ventilated seats market.

Opportunities

There are several opportunities emerging within the auto ventilated seats market, especially as manufacturers explore ways to make the technology accessible in mid-size and compact vehicles. Innovations in low-cost axial and radial fans, along with modular seat construction, are making it more feasible for mass-market OEMs to include ventilated seats in their vehicle portfolios.

Aftermarket demand is another growing segment, where retrofitting of ventilated seating in older or base model vehicles presents a lucrative opportunity. As electric vehicles become more common, there is also an opportunity to integrate ventilated seating systems that align with overall energy efficiency and climate control features. Collaborations between seat manufacturers and climate control system developers will continue to push boundaries and deliver smarter, adaptive comfort solutions.

Challenges

Despite strong momentum, the auto ventilated seats market faces a range of challenges. High installation costs and the complexity of retrofitting ventilated systems limit widespread adoption in budget-conscious regions. Technical limitations, such as fan noise, airflow inconsistencies, or increased power consumption in electric vehicles, can also affect user experience and manufacturer design considerations. Additionally, the integration of these systems requires specific design modifications in seat geometry and materials, adding complexity to the production line. Cost inflation in raw materials like polyurethane foams, electronic components, and plastics may hinder OEM profitability and consumer affordability. The need to maintain performance across diverse climates and driving conditions while meeting fuel efficiency or battery consumption standards also presents engineering challenges.

Regional Insights

The global auto ventilated seats market is geographically dominated by North America, where luxury vehicle penetration is high and consumers prioritize comfort-enhancing features. The region benefits from a robust aftermarket, advanced automotive R&D capabilities, and a favorable climate for ventilated seating. Europe follows closely, with premium car manufacturers such as Mercedes-Benz, BMW, and Audi regularly equipping vehicles with sophisticated seating technologies.

However, the Asia Pacific region is expected to grow at the fastest CAGR, fueled by expanding vehicle production, rising disposable incomes, and an increasing demand for comfort in compact and mid-size vehicles. Countries like China, India, and South Korea are witnessing rapid growth due to evolving consumer expectations and growing investments by international automakers. Latin America and the Middle East, while relatively nascent in adoption, are also beginning to show demand for advanced comfort solutions in premium segments.

Auto ventilated seats market Companies

- Brose Fahrzeugteile GmbH & Co. KG

- DURA Automotive Systems

- Grammer AG

- Hyundai Transys

- Johnson Electric Holdings Limited

- NHK Spring Co., Ltd.

- TACHI-S Co., Ltd.

- Toyota Boshoku Corporation

- TS Tech Co., Ltd.

- Woodbridge Foam Corporation

Recent Developments

- In April 2025, BYD enhanced its comfort offerings by updating the Atto 3 electric SUV with front ventilated seats, making it more competitive in the premium EV space. The update complements other comfort additions such as wireless smartphone connectivity and a powered sunshade. The BYD Seal, also updated the same month, reinforces the company’s focus on climate-adaptive interiors, now featuring a new LFP low-voltage battery that supports efficient seat ventilation performance.

- In October 2024, Skoda Auto announced that its Kylaq sub-4 meter SUV feature first-in-segment ventilated seats with 6-way adjustability for both driver and passenger. The inclusion of ventilated seating in the Kylaq signals Skoda’s intent to redefine comfort benchmarks in India’s compact SUV category.

- In June 2024, Tata Motors launched the Altroz Racer, creating headlines for becoming India’s most affordable car with ventilated front seats. Offered in the top-spec R3 variant, the Altroz Racer provides segment-first comfort at an on-road price of ₹12.86 lakh in Mumbai. It joins the Tata Punch EV as the only other sub-₹15 lakh vehicle to offer ventilated seating, highlighting Tata’s leadership in democratizing premium interior features.

Segments Covered in the Report

By Vehicle Type

- Economy Cars

- Mid-size Cars

- Luxury Cars

By End User

- OEMs

- Aftermarket

By Fan Type

- Axial Fan

- Radial Fan

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Get Sample Link@ https://www.precedenceresearch.com/sample/6210