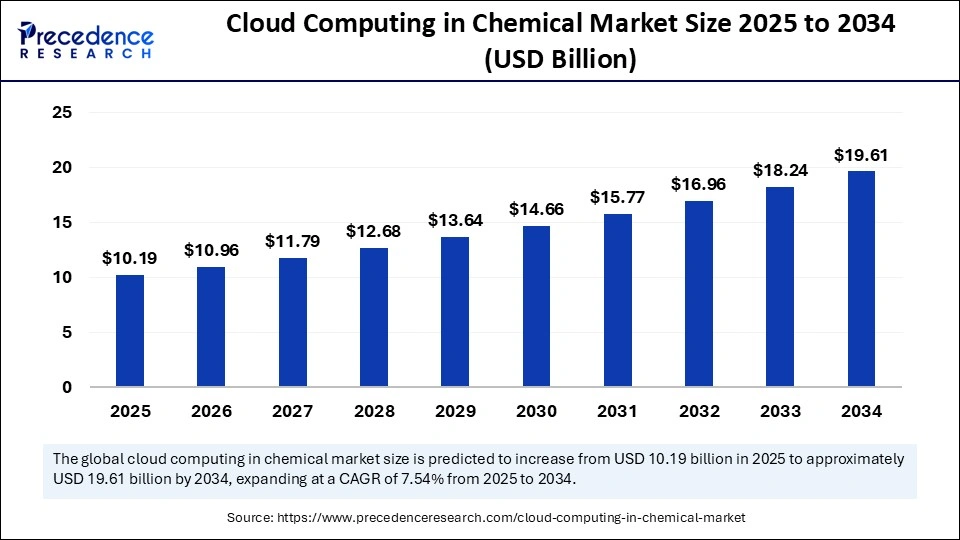

The global cloud computing in chemical market was valued at USD 9.48 billion in 2024 and is projected to reach USD 19.61 billion by 2034, expanding at a CAGR of 7.54% from 2025 to 2034.

Cloud Computing in Chemical Market Key Takeaway

- In 2024, North America held the largest share of the global market, accounting for approximately 37%.

- The Asia Pacific region is forecasted to register the fastest CAGR from 2025 to 2034.

- Among deployment types, the public cloud led the market share in 2024.

- The hybrid cloud segment is projected to record the highest CAGR throughout the forecast period.

- Within services, infrastructure as a service (IaaS) dominated the market in 2024.

- Software as a service (SaaS) is expected to post the fastest growth rate in the coming years.

- In terms of application, the research and development segment secured the largest market share in 2024.

- Supply chain management is expected to be the fastest-growing application segment through 2034.

- The pharmaceutical industry emerged as the top end-user in 2024.

- Specialty chemicals are expected to witness the most notable CAGR between 2025 and 2034.

Market Overview

The cloud computing in chemical market is experiencing a significant transformation as chemical companies increasingly embrace digital technologies to streamline operations, enhance data analytics, and improve decision-making.

Cloud computing is enabling these firms to achieve greater agility, cost-efficiency, and scalability across various production and R&D activities. This market is driven by the rising demand for real-time data access, efficient supply chain management, and advanced modeling capabilities in the chemical industry. As a result, cloud service providers are customizing solutions tailored specifically for chemical manufacturers and suppliers, accelerating adoption across the sector.

Drivers

The primary driver for the cloud computing in chemical market is the growing pressure on chemical companies to modernize their IT infrastructure and reduce operational costs. Cloud platforms facilitate seamless integration of enterprise applications such as ERP, CRM, and supply chain systems.

Furthermore, the need for improved collaboration across global teams and the rise of Industry 4.0 are compelling chemical firms to adopt cloud-based solutions. Environmental regulations and the need for sustainable manufacturing practices are also encouraging companies to implement cloud technologies for efficient resource management and compliance tracking.

Opportunities

Emerging economies present a lucrative opportunity for the cloud computing in chemical market due to their rapid industrialization and digital transformation initiatives. The integration of cloud computing with artificial intelligence and machine learning offers new possibilities for predictive maintenance, demand forecasting, and product innovation. Additionally, the trend of smart manufacturing and the growing focus on cybersecurity in cloud environments are opening up new avenues for solution providers targeting the chemical sector.

Challenges

Despite the advantages, the cloud computing in chemical market faces challenges related to data security, regulatory compliance, and legacy system integration. Many chemical companies still operate on outdated IT frameworks, making cloud migration complex and costly. Concerns around intellectual property protection, especially in R&D processes, are limiting the adoption of public cloud services. Furthermore, vendor lock-in and the lack of skilled personnel to manage hybrid cloud infrastructures are hindering market growth.

Regional Insights

North America leads the cloud computing in chemical market, fueled by early adoption of digital technologies and strong presence of key cloud service providers. Europe follows closely, with countries like Germany and the UK investing heavily in smart manufacturing initiatives.

The Asia-Pacific region is expected to witness the fastest growth due to increased industrial activities in China and India, along with government-backed digitalization programs. Latin America and the Middle East are gradually adopting cloud technologies, driven by investments in the chemical and petrochemical sectors.

Recent Developments

Recent developments in the cloud computing in chemical market include strategic partnerships between cloud providers and chemical companies to co-develop industry-specific solutions. Several players have launched cloud-based platforms with built-in compliance tools for chemical regulations.

Moreover, the adoption of multi-cloud and hybrid cloud strategies is increasing as companies aim to enhance flexibility and minimize risks. Innovations such as digital twins and blockchain-based traceability systems are being integrated into cloud platforms, signaling a shift towards more intelligent and secure chemical manufacturing.

Cloud Computing in Chemical Market Companies

- Amazon Web Services

- Alibaba Cloud

- DigitalOcean

- IBM

- Google Cloud

- Microsoft

- Cisco

- Linode

- Huawei

- VMware

- Red Hats

- Oracle

- SAP

- Salesforce

- Rackspace

Segments Covered in the Report

By Deployment

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Service

- Infrastructure as a Service

- Platform as a Service

- Software as a Service

By Application

- Research and Development

- Supply Chain Management

- Data Management

By End-User

- Pharmaceutical

- Agricultural Chemicals

- Specialty Chemicals

- Petrochemical

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa