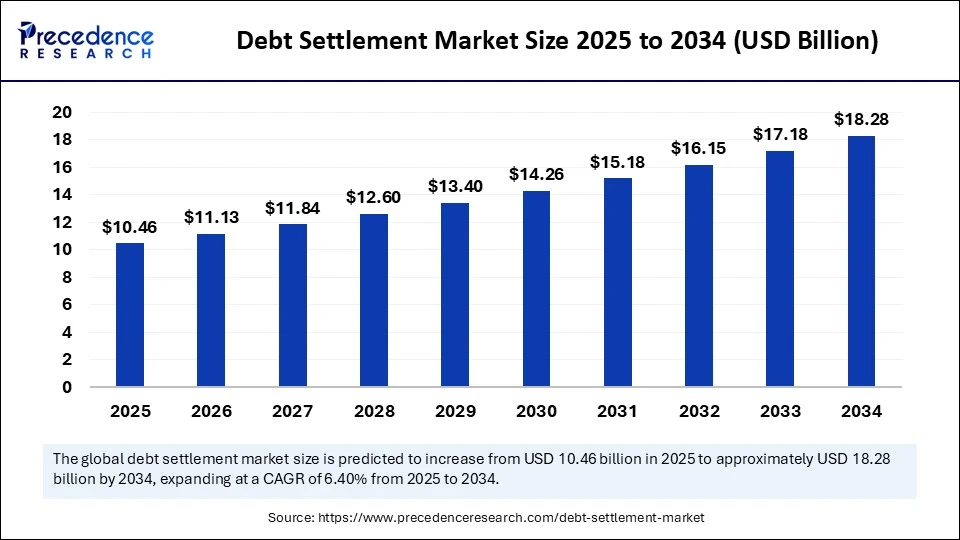

The global debt settlement market size is estimated to reach around USD 18 28 billion by 2034 increasing from USD 9 83 billion in 2024, with a CAGR of 6 40

Debt Settlement Market Key Takeaways

- The debt settlement market was worth USD 9.83 billion in 2024.

- It is expected to grow to USD 18.28 billion by 2034.

- The market is growing at a 6.40% CAGR from 2025 to 2034.

- North America had the highest revenue in 2024.

- Asia Pacific is expected to grow quickly during the forecast period.

- Credit card debt settlement was the leading segment by type in 2024.

- Personal loan debt settlement is set to grow steadily through 2034.

- Debt negotiation services made up the biggest market share in 2024.

- Debt counselling is expected to expand steadily over the coming years.

- Most customers in 2024 were individual consumers.

- SMEs are projected to become a fast-growing user group.

- Offline sales channels led in 2024.

- Online platforms are expected to grow strongly between 2025 and 2034.

How is AI Impacting on Debt Settlement Solution?

AI is changing how debt settlement market works—making it faster, easier, and more personalized. Where expert advisors once handled all negotiations, AI now helps both professionals and customers by automating key parts of the process. It can negotiate settlements, reduce the need for manual work, and offer smart recommendations based on personal data.

AI tools also spot trends and patterns in consumer debt, helping create better strategies for quicker and more effective settlements. Companies are using these tools to offer around-the-clock support, clearer guidance, and a smoother experience for people working through their debts.

- In April 2025, Kikoff—a credit-building platform used by over a million Americans—introduced AI Debt Negotiation. This voice-based AI agent can negotiate with creditors on behalf of users, making the process of dealing with debt much less stressful.

Market Overview

The debt settlement market intersects with credit portfolio management and creditor-side strategies, From an institutional standpoint. Banks, credit card issuers, and fintech lenders increasingly employ settlement arrangements as part of their loss mitigation toolkit. These institutions often outsource negotiation services to specialized firms or deploy internal teams to settle non-performing consumer loans.

The market thus spans both demand-side (consumer seekers) and supply-side (creditor partners) dimensions. It includes bulk settlement strategies, where large credit portfolios are negotiated in batches, often during economic downturns. This dimension has grown in importance as financial institutions face elevated default portfolios and seek structured approaches to minimize net losses.

Get Sample Link @https://www.precedenceresearch.com/sample/6405

Drivers

For creditors and institutions, key drivers include managing rising default rates, optimizing recovery yields, and reducing provisioning costs. Economic downturns and credit stress cycles expose banks to growing non-performing assets, prompting them to engage settlement providers to resolve delinquencies efficiently. Regulatory capital requirements also incentivize proactive resolution, as settled debts reduce non-performing asset ratios and free up capital.

Moreover, interest rate hikes and macroeconomic uncertainty increase the attractiveness of settlement as a cost-effective alternative to bankruptcy or lengthy collections. Lenders are also compelled to maintain regulatory compliance and consumer protection obligations, making outsourced settlement firms with compliant frameworks appealing. Technological integration—such as API connectivity between lenders and settlement platforms—streamlines negotiations and automates approvals, boosting efficiency.

Opportunities

Institutions present substantial opportunities for settlement service providers. Expanding B2B offerings—such as bulk portfolio settlement, integration with lender CRM systems, real-time offer automation, and data analytics benchmarking—can differentiate providers. Embedding settlement services into creditor-first systems helps lenders proactively offer ‘pre-default’ negotiations or hardship programs. Another opportunity lies in offering predictive scoring modules that identify eligible delinquent accounts most likely to settle, improving recovery efficiency and success rates.

Cross-selling to creditors value-added services—like compliance audits, performance reporting dashboards, and credit score impact analysis—can enhance recurrent revenue. In emerging economies, as financial inclusion expands and digital lending grows quickly, institutional demand for scalable settlement infrastructure is likely to rise, offering growth potential across multiple markets.

Challenges

This institutional segment faces its own challenges. Negotiating bulk settlement agreements requires sophisticated data analytics, legal structuring, and operational coordination across many accounts and creditors, which can be complex and time-consuming. Smaller lenders may resist outsourcing or lack the volume to justify external vendor arrangements. Regulatory scrutiny involving settlements may increase liability concerns for institutions—particularly regarding disclosure, fairness, and documentation.

Predictive models may produce errors in identifying ideal settlement candidates, reducing success rates or causing reputational damage. Fee structure negotiations between settlement providers and lenders can become contentious, particularly around contingencies and performance metrics. Additionally, institutional inertia and integration hurdles—where lenders must align legacy systems, compliance processes, and operational workflows—can slow adoption of advanced settlement tools.

Recent Developments

Lately, several debt settlement providers have unveiled institutional-grade settlement platforms equipped with API connectivity for bulk-account data ingestion, automated offer simulation, and dashboard reporting for performance metrics. These platforms support real-time negotiation via interface integration, enabling lenders to automate settlement offers for eligible accounts without manual intervention. Some providers have launched predictive scorecards that scan creditor portfolios to identify accounts most likely to settle successfully, optimizing lender responsibilities and reducing wasted outreach.

A few new firms are packaging analytics modules that benchmark institutional settlement performance against peer cohorts. Regulatory shifts in some jurisdictions have required providers to strengthen compliance controls and documentation trails; in turn, service firms have introduced audit-ready solution frameworks and client dashboards that monitor fairness metrics and fee transparency. Finally, partnerships with fintech lenders and neobanks are emerging, allowing settlement tools to be embedded within digital credit platforms, offering pre-emptive negotiation options before formal default.

Debt Settlement Market Companies

- Freedom Debt Relief

- CuraDebt

- Pacific Debt Inc.

- New Era Debt Solutions

- Accredited Debt Relief

- National Debt Relief

- American Financial Solutions

- Beyond Finance

- CreditAdjusters

- Consolidated Credit Counseling Services

- Alliance Credit Counseling

- DMB Financial LLC

Segment Covered in the Report

By Type

- Credit Card Debt Settlement

- Mortgage Debt Settlement

- Student Loan Debt Settlement

- Medical Debt Settlement

- Personal Loan Debt Settlement

- Others

By Service Type

- Debt Negotiation Services

- Debt Counseling Services

- Debt Management Plans

- Legal Assistance for Debt Settlement

- Others

By End-user

- Individual Consumers

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Distribution Channel

- Online/Digital Platforms

- Offline/Traditional Channels

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Also Read@ https://www.precedenceresearch.com