Fire Insurance Market Key Takeaways

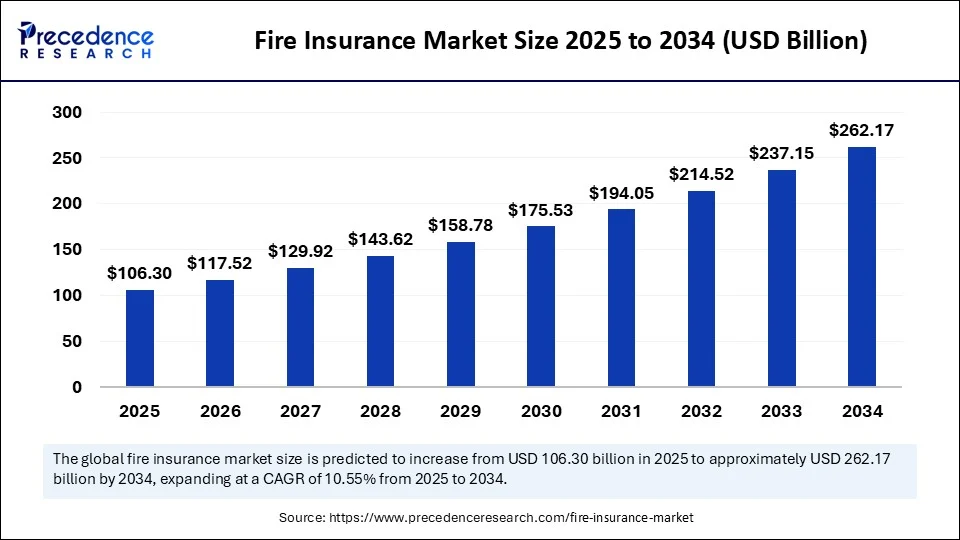

- The global fire insurance market was valued at USD 96.16 billion in 2024.

- It is projected to reach USD 262.17 billion by 2034.

- The market is expected to grow at a CAGR of 10.55% between 2025 and 2034.

- North America dominated the market with a 41% share in 2024.

- Asia Pacific is projected to witness the fastest CAGR during the forecast period.

- By coverage type, property fire insurance held the largest market share in 2024.

- Business interruption insurance is anticipated to grow at the fastest CAGR by coverage type.

- By property type, commercial property accounted for the highest market share in 2024.

- Industrial property is forecast to register the fastest CAGR in the coming years.

- Annual policies held the dominant share by policy term in 2024.

- Multi-year policies are expected to expand at the fastest CAGR from 2025 to 2034.

- The high-deductible fire insurance segment captured the largest market share in 2024.

- The low-deductible fire insurance segment is projected to grow at the fastest CAGR moving forward.

- By distribution channel, brokers led the market in 2024.

AI Impact on the Fire Insurance Market

Artificial intelligence is transforming the fire insurance market by enabling more accurate risk assessment at specific locations using historical data. These advanced insights help insurers calculate precise premiums tailored to individual properties. AI-driven tools streamline the entire claims process—from the initial notification to final settlement—enhancing speed, reducing human involvement, and improving accuracy in claim verification. Fraud detection, a persistent challenge in fire insurance, has also improved significantly through AI-powered systems that identify suspicious patterns and anomalies often missed by human investigators. Additionally, AI-enabled data analytics allows insurers to extract valuable insights from large data sets, supporting smarter business strategies, product innovation, and refined risk evaluation. These capabilities further support dynamic pricing models, enabling insurers to remain competitive, respond to customer needs effectively, and develop more personalized and efficient insurance offerings.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/6324

Market Overview

The fire insurance market has become an essential segment within the global insurance industry, driven by the rising risk of fire-related damages in both residential and commercial properties. With increasing awareness of disaster preparedness, insurance coverage for fire-related losses has seen a significant surge. Fire insurance policies are designed to cover damages caused by accidental fires, electrical faults, wildfires, and even arson. Growing urbanization, industrialization, and climate-related fire risks have further fueled demand. The market is undergoing rapid transformation with the integration of digital technologies such as AI, big data, and IoT, making fire risk assessment and claims management more precise and efficient.

Drivers

One of the major drivers of the fire insurance market is the increasing frequency and severity of fire incidents globally. Climate change has significantly contributed to longer and more intense wildfire seasons, particularly in North America, Australia, and Southern Europe. Additionally, rising investments in real estate, commercial buildings, and industrial infrastructure have led to increased awareness about protecting physical assets through insurance. Government regulations mandating fire insurance for certain types of properties and businesses further support market growth. The digital transformation within the insurance sector is also accelerating adoption, with online platforms making it easier to compare, purchase, and manage fire insurance policies. The integration of AI and predictive analytics allows insurers to offer dynamic pricing based on specific risk profiles, thereby increasing product personalization and consumer trust.

Opportunities

The fire insurance market presents vast opportunities, especially in developing regions where insurance penetration remains relatively low. Rapid infrastructure development in Asia Pacific and parts of Latin America creates a strong demand for risk mitigation through fire coverage. Emerging technologies such as smart building systems and IoT sensors offer insurers real-time data on temperature fluctuations, smoke detection, and system failures, allowing for proactive risk management and prevention services. These advancements not only improve underwriting practices but also open new revenue streams such as fire prevention consulting and risk management services. Digital-first insurance companies, or insurtechs, are also poised to disrupt traditional models by offering subscription-based or pay-as-you-go fire insurance products, tailored to evolving consumer preferences. Furthermore, integrating fire insurance into larger property and casualty packages presents a cross-selling opportunity that could significantly enhance customer lifetime value.

Challenges

Despite its strong growth prospects, the fire insurance market faces several challenges. One significant issue is the increasing cost of claims due to inflation in construction materials, repair services, and temporary housing. Additionally, high-risk zones such as forest-adjacent communities are becoming increasingly difficult to underwrite, leading to higher premiums or withdrawal of coverage altogether. Fraudulent claims also pose a substantial problem, and although AI is improving fraud detection, it has not yet completely eliminated the risk. A lack of awareness and education around fire insurance in low-income regions continues to restrict market penetration. Furthermore, inconsistencies in regulatory frameworks across countries and even states can make it difficult for insurers to operate efficiently on a global scale. Data privacy concerns, particularly related to AI-driven underwriting, remain an area of scrutiny for regulators and consumers alike.

Regional Insights

Regionally, North America led the global fire insurance market with a dominant share of 41% in 2024. The United States, in particular, has seen rising demand due to wildfire risks in states like California and increasing urban development. Europe is another mature market with strong regulatory frameworks and high consumer awareness. However, the fastest growth is expected from the Asia Pacific region, driven by urban expansion, infrastructure investment, and government-backed disaster risk reduction initiatives. Countries like China, India, and Indonesia are witnessing a surge in demand for commercial and residential fire insurance products. Latin America and the Middle East & Africa are also slowly gaining momentum, especially with more construction activity and the rising importance of property protection in national development strategies.

Recent Developments

The fire insurance market has witnessed several noteworthy developments in recent years. Insurers are rapidly adopting AI-powered tools for claims automation and fraud detection. Predictive analytics platforms are being used to assess risk levels at a granular level, enabling personalized policy offerings. In 2025, several insurers began offering satellite-imaging-based fire risk assessments to improve underwriting accuracy. Partnerships between insurance providers and smart home companies have also emerged, with integrated smoke detectors and fire alarms offering policy discounts and early warning systems. Some governments are working with insurers to develop public-private insurance models to make fire coverage more accessible in high-risk zones. These innovations are setting the stage for a smarter, more resilient global fire insurance market.

Fire Insurance Market Companies

- Allstate Insurance Company

- Travelers Companies, Inc.

- Tokio Marine Nichido Fire Insurance Co., Ltd.

- Generali Group

- The Hartford Financial Services Group, Inc.

- Zurich Insurance Group Ltd

- Nationwide Mutual Insurance Company

- State Farm Mutual Automobile Insurance Company

- Ping An Insurance (Group) Company of China, Ltd.

- Munich Reinsurance Company

- Allianz SE

- Farmers Insurance Group of Companies

- Chubb Ltd.

- AXA SA

- Liberty Mutual Insurance Group, Inc.

Segments Covered in the Report

By Coverage Type

- Property Fire Insurance

- Business Interruption Insurance

- Commercial Fire Insurance

- Industrial Fire Insurance

- Residential Fire Insurance

By Property Type

- Commercial Property

- Industrial Property

- Residential Property

By Policy Term

- Annual Policies

- Multi-Year Policies

- Short-Term Policies

By Deductible

- High-Deductible Fire Insurance

- Low-Deductible Fire Insurance

By Distribution Channel

- Brokers

- Captive Agents

- Direct Writers

- Independent Agents

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Also Read: Perishable Prepared Food Market

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/