Fusion Energy Market Key Takeaways

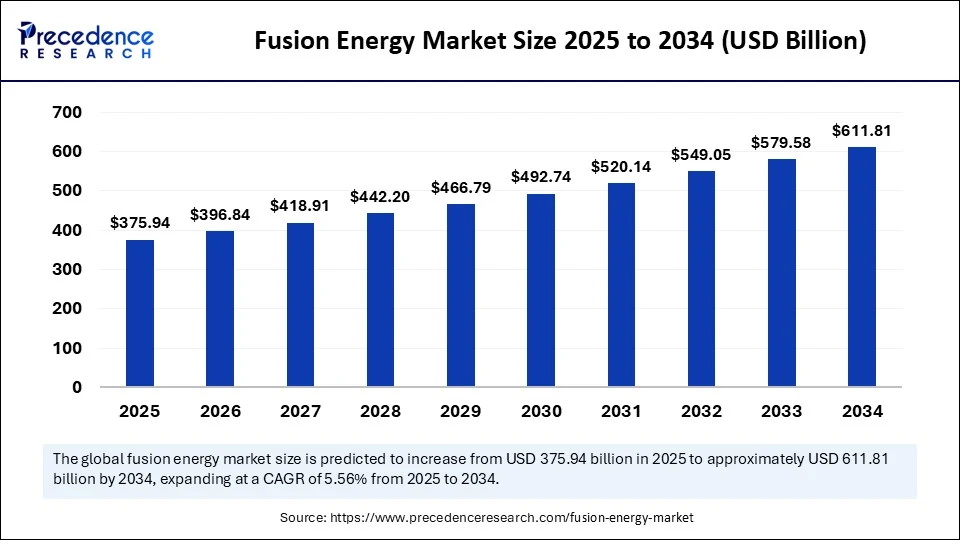

- The global fusion energy market was valued at USD 356.14 billion in 2024.

- It is forecast to reach USD 611.81 billion by 2034, growing at a CAGR of 5.56% from 2025 to 2034.

- North America led the market with the largest share of 36% in 2024.

- Asia Pacific is projected to register the fastest CAGR during the forecast period.

- By technology, magnetic confinement fusion held a dominant market share in 2024.

- Inertial confinement fusion is expected to grow at the fastest CAGR between 2025 and 2034.

- The power generation segment was the leading application in 2024.

- The space propulsion segment is expected to expand significantly from 2025 onward.

- By fuel type, deuterium-tritium captured the major market share in 2024.

- Deuterium-deuterium is projected to grow at a significant CAGR during the forecast period.

- Public sector investments accounted for the highest market share in 2024.

- Among system types, pilot plants generated the major market share in 2024.

- Commercial reactors are anticipated to grow at a notable CAGR through 2034.

Impact of Artificial Intelligence on the Fusion Energy Market

Artificial intelligence (AI) is transforming the fusion energy market by boosting the performance of reactors, accelerating research, and cutting development costs. Scientists can use AI to accurately predict plasma behavior, enabling real-time adjustments that stabilize fusion reactions and prevent energy loss. AI assists in designing more efficient and stable reactor configurations by simulating and optimizing complex systems. AI also minimizes downtime by predicting equipment failures and suggesting design improvements, leading to the development of next-generation reactors.

Get a Free Sample Copy of the Report@ https://www.precedenceresearch.com/sample/6314

Market Overview

The fusion energy market is gaining unprecedented momentum as countries and corporations race to find sustainable, safe, and near-limitless energy sources. Fusion energy, derived by fusing atomic nuclei to release energy, is widely regarded as the “holy grail” of clean energy due to its ability to produce power without emitting greenhouse gases or long-term radioactive waste. The fusion energy market was valued at USD 356.14 billion in 2024 and is projected to reach USD 611.81 billion by 2034, growing at a CAGR of 5.56% during the forecast period. With global electricity demand projected to double by mid-century and increasing pressure to decarbonize, fusion energy is emerging as a key solution. Significant technological advances, rising private and public investments, and collaborative international research projects such as ITER are propelling the market toward commercialization.

Drivers

One of the primary drivers of the fusion energy market is the urgent global need for low-carbon energy alternatives amid growing concerns over climate change. Fusion power offers a virtually limitless energy supply using isotopes like deuterium and tritium, which are abundant and widely accessible. Unlike fission, fusion does not pose long-term waste challenges, making it an environmentally attractive option. The increasing instability of fossil fuel markets and rising prices of conventional energy sources are also pushing governments and private entities to invest in fusion projects. Technological progress in high-temperature superconductors, advanced magnetics, and AI-driven plasma control systems is enabling scalable fusion designs. Moreover, fusion energy’s ability to integrate into existing power grids without major modifications makes it a practical choice for future energy planning.

Opportunities

The fusion energy market presents substantial opportunities for innovation, investment, and cross-sector collaboration. As nations race to achieve net-zero emissions, the demand for clean base-load power is creating fertile ground for fusion energy commercialization. A growing number of private companies, particularly in North America and Europe, are developing compact fusion reactors that promise faster deployment and lower costs. Opportunities are also emerging in ancillary markets such as superconducting magnets, cryogenic systems, and neutron-resistant materials. The potential application of fusion energy in space propulsion offers another layer of market expansion, with deep space exploration missions envisioning fusion as the key energy source. Governments are increasingly supporting public-private partnerships, offering grants, subsidies, and regulatory frameworks to support R&D and pilot plant construction, further expanding growth possibilities for the fusion energy market.

Challenges

Despite its promise, the fusion energy market faces considerable challenges that could delay commercialization. One of the primary hurdles is the technical complexity of sustaining a stable plasma reaction for extended periods and at a scale that delivers net energy output. High costs associated with building demonstration plants and the need for rare or specialized materials also limit rapid scalability. Regulatory uncertainties and a lack of harmonized international safety protocols pose barriers to global adoption. Furthermore, competition from rapidly expanding renewable energy sources like solar and wind may divert funding and public interest away from fusion. Public skepticism and lack of awareness about the safety and feasibility of fusion energy also present long-term market constraints. Additionally, integration into energy markets dominated by existing infrastructure and players could slow acceptance of fusion as a mainstream solution.

Regional Insights

Regionally, the North American fusion energy market dominates with a 36% share in 2024, driven by robust R&D investment and supportive regulatory environments in the United States and Canada. The U.S. Department of Energy, through initiatives like ARPA-E and partnerships with companies like Commonwealth Fusion Systems, is fostering innovation and pilot plant development. Europe, particularly the UK, Germany, and France, is also advancing rapidly, with institutions like EUROfusion and Joint European Torus (JET) playing central roles. The Asia Pacific region is forecasted to grow at the fastest CAGR between 2025 and 2034, led by China, South Korea, and Japan. These countries are investing heavily in domestic fusion programs while participating in international collaborations. China’s Experimental Advanced Superconducting Tokamak (EAST) has made global headlines for its record-breaking plasma experiments. Regions like Latin America and the Middle East are in nascent stages but are exploring feasibility studies and technology licensing.

Recent Developments

Recent developments in the fusion energy market are accelerating its path toward commercialization. In 2025, several startups made headlines for achieving record plasma confinement times and initiating the construction of compact demonstration reactors. Commonwealth Fusion Systems began work on its SPARC pilot plant with the goal of reaching net energy gain by 2028. TAE Technologies and Helion Energy have also attracted major funding rounds, signaling investor confidence. Additionally, international collaborations continue to progress, with ITER completing major construction milestones and targeting full deuterium-tritium operation within the next decade. AI is playing a growing role in real-time plasma monitoring and predictive maintenance, reducing the risk of system failures. Governments are also revising national energy policies to include fusion energy within their renewable portfolios, further legitimizing the sector. These trends indicate that the fusion energy market is moving from a long-term scientific dream to a viable commercial reality.

Fusion Energy Market Companies

- Commonwealth Fusion Systems

- European Organization for Nuclear Research

- First Light Fusion

- General Fusion

- Helion Energy

- ITER Organization

- Korea Superconducting Tokamak Advanced Research

- Lawrence Livermore National Laboratory

- MAX IV Laboratory

- National Renewable Energy Laboratory

- Princeton Plasma Physics Laboratory

- Russian Federal Nuclear Center

- Tokamak Energy

- United States Department of Energy

Segments Covered in the Report

By Technology Outlook

- Inertial Confinement Fusion

- Magnetic Confinement Fusion

- Spheromaks

- Stellarators

By Application Outlook

- Industrial Applications

- Power Generation

- Research and Development

- Space Propulsion

By Fuel Type Outlook

- Proton-Boron

- Deuterium-Tritium

- Deuterium-Deuterium

By System Type Outlook

- Pilot Plants

- Experimental Reactors

- Commercial Reactors

By Investment Type Outlook

- International Collaborations

- Private Sector Investments

- Public Sector Investments

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Also Read: Perishable Prepared Food Market

Ready for more? Dive into the full experience on our website@ https://www.precedenceresearch.com/