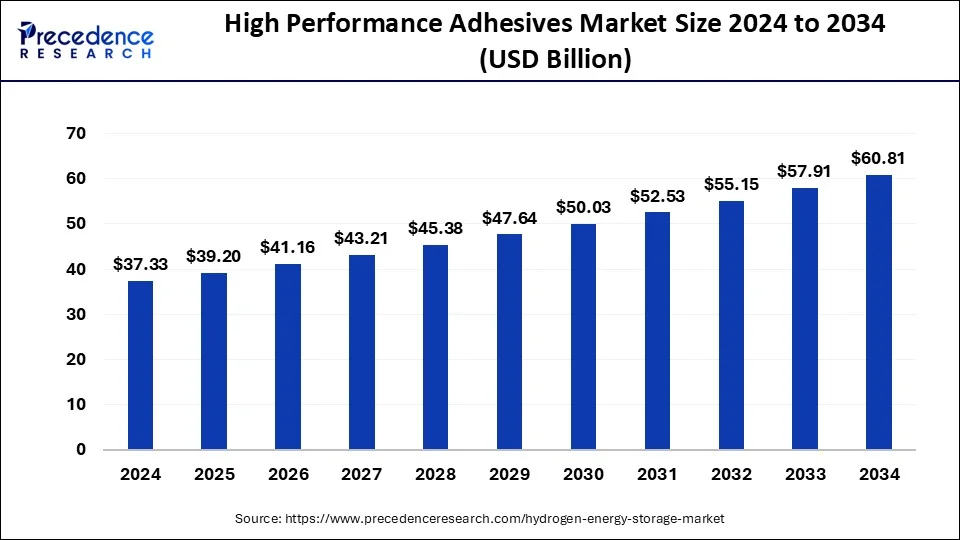

The high-performance adhesives market will grow steadily, hitting USD 60.81 billion by 2034 from USD 37.33 billion in 2024 with a 5% CAGR.

High Performance Adhesives Market Key Takeaways

- In 2023, Asia Pacific led the high-performance adhesives market with the highest share of 44%.

- The epoxy segment maintained the largest market share by product in 2023.

- The solvent-based segment recorded the maximum revenue share by technology in 2023.

- The medical segment is anticipated to grow at the fastest CAGR during the forecast period.

Market Overview

The high performance adhesives market is gaining traction due to the growing demand for reliable bonding solutions across various industries. These adhesives offer exceptional adhesion properties, thermal resistance, and chemical durability, making them ideal for use in industries such as automotive, aerospace, electronics, and construction. The increasing focus on lightweight vehicles, energy efficiency, and miniaturized electronic devices is fueling the adoption of high performance adhesives. Additionally, the push for sustainability and eco-friendly adhesives has led to the development of bio-based and low-VOC adhesives. As industries continue to embrace technological advancements and stringent regulatory requirements, the market for high performance adhesives is expected to grow at a robust pace.

Drivers

- Growing Demand in Construction and Infrastructure Projects

The rising investments in construction and infrastructure projects, particularly in developing economies, are driving the demand for high performance adhesives. These adhesives provide strong bonding for building materials and ensure structural integrity in challenging environments. - Increased Use in Medical and Healthcare Applications

High performance adhesives are widely used in the medical and healthcare sector for applications such as medical device assembly, wound care, and surgical instruments. The increasing demand for reliable and durable adhesives in critical healthcare applications is contributing to market growth. - Rising Adoption of Lightweight and Composite Materials

The growing trend of using lightweight and composite materials in automotive and aerospace industries is boosting the demand for high performance adhesives. These adhesives enhance the strength and performance of lightweight components, ensuring durability and efficiency.

Opportunities

- Expansion in the Automotive EV Sector

The shift towards electric vehicles (EVs) presents significant growth opportunities for high performance adhesives. These adhesives play a crucial role in battery assembly, thermal management, and structural bonding in EVs, ensuring safety and efficiency. - Advancements in Smart and Wearable Devices

The increasing adoption of smart devices and wearable technologies creates a demand for high performance adhesives that offer precision bonding and high durability. These adhesives enable the miniaturization of electronic components while maintaining performance. - Development of High-Temperature Resistant Adhesives

Innovations in high-temperature resistant adhesives are expanding the application scope of high performance adhesives in industries such as aerospace, automotive, and electronics. These adhesives enhance performance in extreme operating conditions, opening new growth avenues.

Challenges

- Environmental Concerns and VOC Regulations

Strict regulations related to VOC emissions and environmental concerns are a challenge for the high performance adhesives market. Manufacturers need to invest in sustainable formulations and production processes to comply with regulatory standards. - Complex Production Processes and High Costs

The production of high performance adhesives involves complex processes and high costs, which can impact the overall profitability of manufacturers. Balancing cost efficiency while maintaining quality remains a significant challenge. - Lack of Skilled Workforce in Emerging Markets

The adoption of high performance adhesives in emerging markets is hindered by a lack of technical expertise and knowledge. Training and education initiatives are necessary to bridge this gap and promote market growth.

Regional Insights

- North America

North America dominates the high performance adhesives market, supported by advancements in automotive, aerospace, and electronics industries. The region’s focus on sustainability and energy-efficient solutions further boosts market growth. - Europe

Europe is a key market for high performance adhesives, driven by strict environmental regulations and the increasing adoption of bio-based adhesives. The region’s automotive and renewable energy sectors contribute significantly to market demand. - Asia Pacific

Asia Pacific is poised to witness the highest growth rate, with increasing demand from construction, automotive, and electronics sectors. Rapid industrialization and favorable government initiatives in countries such as China and India are driving market expansion. - Latin America and Middle East & Africa

These regions are experiencing gradual market growth due to rising investments in construction and infrastructure. However, challenges such as limited technical expertise and awareness continue to affect market penetration.

Recent News

- Launch of Advanced Adhesive Solutions for EV Applications

Leading companies are introducing innovative adhesive solutions tailored for electric vehicles, addressing the growing demand for lightweight and high-performance materials in the EV sector. - Partnerships and Acquisitions to Strengthen Market Presence

Key market players are focusing on strategic partnerships and acquisitions to enhance their market position and expand their product offerings. These collaborations are expected to drive technological advancements and market growth.

High Performance Adhesives Market Companies

- 3M

- Sika AG

- B. Fuller Company.

- Bostik

- Pidilite Industries Limited

- Engineered Bonding Solution

- Anabond

- Huntsman International LLC.

- Ashland

- Henkel

- Permabond LLC

- Delo Industrial Adhesives, LLC

- WEICON GmbH & Co.KG

- Gougeon Brothers

- Royal Adhesives & Sealants, LLC

- Ashland Inc

- Hernon Manufacturing

Segments Covered in the Report

By Technology

- Solvent based

- Hot melt

- Water based

- Reactive & others

By Product

- Polyurethane

- Silicone

- Epoxy

- Acrylic

- Others

By End-User

- Electrical & electronics

- Packaging

- Medical

- Transportation

- Construction

- Others

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Middle East & Africa

- Latin America