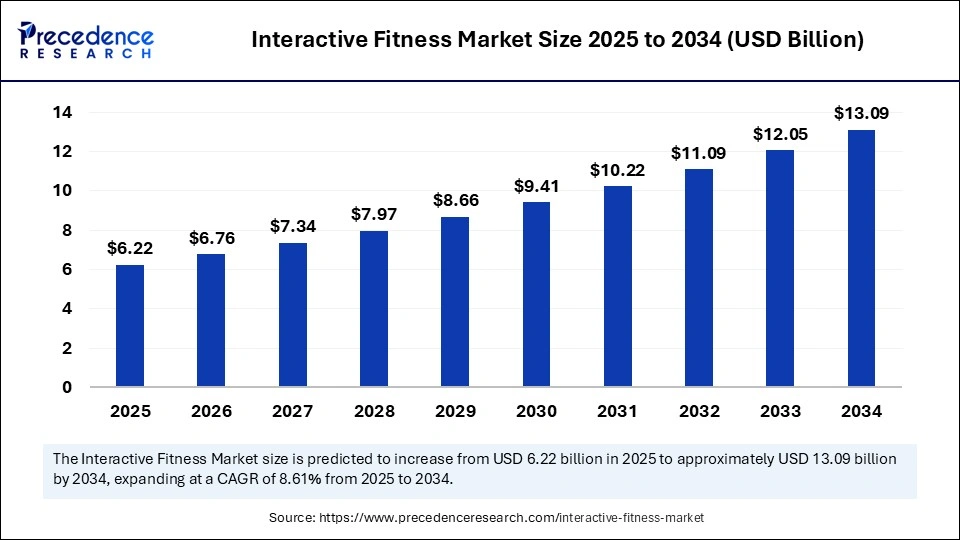

The global interactive fitness market size is valued to reach around USD 13.09 billion by 2034 increasing from USD 5.73 billion in 2024, with a CAGR of 8. 61%.

Interactive Fitness Market Key Takeaways

- In terms of revenue, the interactive fitness market is valued at $6.22 billion in 2025.

- It is projected to reach $13.09 billion by 2034.

- The market is expected to grow at a CAGR of 8.61% from 2025 to 2034.

- North America dominated the interactive fitness market with the largest revenue share in 2024.

- Asia Pacific is expected to grow at the fastest CAGR between 2025 and 2034.

- By product, the fitness equipment segment held the major revenue share of the market in 2024.

- By product, the software system segment is expected to grow at the highest CAGR during the forecast period.

- By application, the household segment contributed the biggest revenue share in 2024.

- By application, the gym segment is expected to expand at a significant CAGR in the coming years.

- By end-user, the residential segment dominated the market in 2024.

- By end-user, the non-residential segment is expected to register the fastest CAGR over the projection period.

Impact of Artificial Intelligence on the Interactive Fitness Market

-

Real‑time tracking: AI captures performance data live (e.g. heart rate, motion) to personalize workout intensity and form.

-

Adaptive planning: Machine learning shapes and refines plans based on injury recovery, progress, and personal goals.

-

Improved outcomes: AI‑powered coaching accelerates results and boosts engagement, driving long‑term use.

-

Virtual coaching: Instant feedback via voice, video, or sensor tech simulates an in‑person trainer experience.

Market Overview

Interactive fitness draws users into a digitized wellness ecosystem where physical workouts are enhanced by live coaching, real‑time feedback, gamification, and immersive multimedia. Home use dominates current revenue share, with fitness equipment like stationary bikes, smart treadmills, connected rowers, mirrors, wearables, and software platforms forming the backbone.

Get Sample Link @https://www.precedenceresearch.com/sample/6203

Growth Drivers

Consumer preferences have shifted toward personalized, engaging fitness experiences that seamlessly adapt to busy lifestyles. AI‑driven coaching delivers tailored workouts and adaptive difficulty, while wearable data close the feedback loop. Younger consumers’ strong affinity for wellness, community features, and gamified challenges keeps them engaged. The shift toward remote and hybrid lifestyles post‑pandemic has embedded digital fitness into daily routines. Integration with wellness apps—for meditation, recovery, nutrition—furthers brand appeal. Online sales channels make it easy to buy equipment and subscribe to services, accelerating adoption globally.

Emerging Opportunities

Immersive experiences such as AR/VR workouts and exergaming titles open new engagement pathways, especially among younger, tech‑savvy users. Gamified titles like Sportvida CyberDash exemplify the future of fitness as play. In emerging markets, a mobile-first generation and growing wellness culture create ripe opportunities for lower-cost, accessible devices and subscription platforms. AI coaching, when combined with biometric smart garments, promises precise, feedback‑rich workout sessions. Wellness platforms that integrate fitness, recovery, mental health, and mood tracking are gaining traction. Corporate wellness adoption continues growing, presenting recurring, enterprise‑scale opportunities.

Industry Challenges

Users may balk at high‑cost devices and recurring subscriptions, especially when cheaper alternatives exist. The pace of innovation makes hardware quickly obsolete. Collecting sensitive personal data raises privacy and security concerns; many users worry about consent and control. Platform fragmentation and vendor lock‑in reduce cross‑compatibility. Keeping content fresh is essential to avoid user disengagement. Economic uncertainty and shifting regulatory regimes pose additional risks to scaling internationally.

Recent Developments

Peloton’s strategic pivot in early 2025 toward software‑first subscription growth has delivered improved profit forecasts, stronger subscriber numbers, and partnerships with retailers like Costco and Lululemon. AR/VR integration accelerated in 2024 and 2025, with immersive workout platforms launching across consumer and home fitness markets.

Wearable sensor technologies evolved beyond wrist devices—smart textile sportswear using deep learning models can now analyze muscle symmetry and breathing patterns in real time. Fitness and wellness apps are embedding mental health and recovery modules alongside workouts to deliver a unified wellness experience. Fitness gaming continues expanding, with titles providing high‑energy, game‑based cardio workouts supported by evolving virtual platforms.

Interactive Fitness Market Companies

- Axtion Technology LLC

- BowFlex Inc.

- EGYM Inc.

- Evervue USA Inc.

- Motion Fitness LLC

- Nexersys Corp

- Paradigm Health and Wellness Inc.

- Peloton Interactive Inc.

- SMARTfit Inc.

- TECHNOGYM Spa

Segments Covered in the Report

By Product

- Fitness Equipment

- Software System

By Application

- Gym

- Household

By End-User

- Residential

- Non-residential

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Also Visit @https://www.precedenceresearch.com/