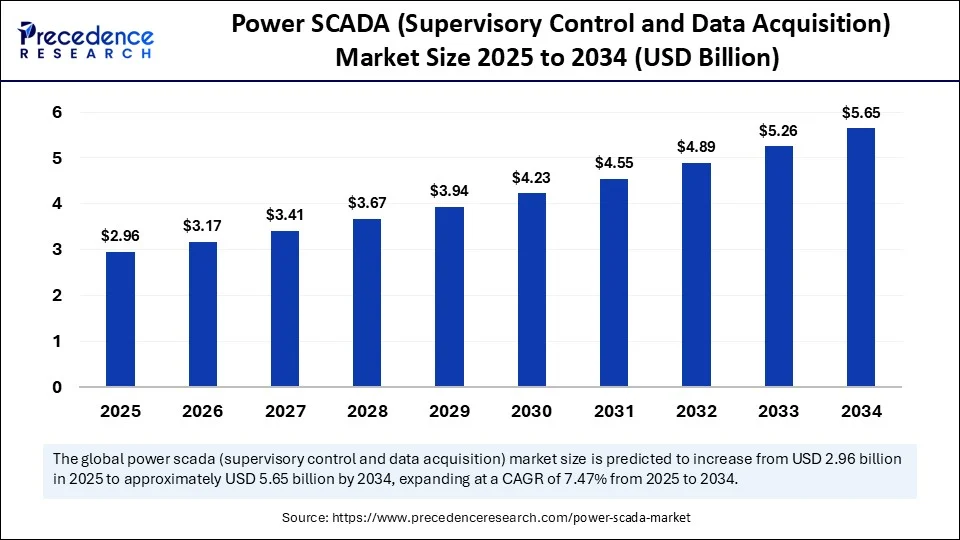

The global power SCADA market size is accounted to reach around USD 5.65 billion by 2034 from USD 2.75 billion in 2024, with a CAGR of 7.47%

Power SCADA (Supervisory Control and Data Acquisition) Market Key Takeaways

- In terms of revenue, the global power SCADA (Supervisory Control and Data Acquisition) market was valued at USD 2.75 billion in 2024.

- It is projected to reach USD 5.65 billion by 2034.

- The market is expected to grow at a CAGR of 7.47% from 2025 to 2034.

- North America dominated the power SCADA (Supervisory Control and Data Acquisition) market with the largest market share of 42% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the upcoming years.

- By component, the hardware segment held the biggest share in 2024.

- By component, the software segment is observed to grow at the fastest CAGR during the forecast period.

- By architecture, the open system architecture (OSA) segment generated the highest market share in 2024.

- By architecture, the closed system architecture segment is expected to grow at the fastest CAGR in the coming years.

- By deployment model, the on-premises segment captured the highest market share in 2024.

- By deployment model, the cloud-based is emerging as the fastest growing segment during the forecast period.

- By end-use industry, the power generation segment generated the major market share in 2024.

- By end-use industry, the non-renewables segment is emerging as the fastest growing.

How does artificial intelligence enhance operational efficiency of power SCADA systems?

Integrating AI into power SCADA systems transforms them into intelligent platforms that streamline operations through real-time insights, predictive maintenance, and automated decision-making. By analyzing vast SCADA-generated data, AI reveals inefficiencies and abnormal behavior invisible to conventional systems, enabling optimized load balancing and failure prediction. AI further supports automated control adaptations and short-term demand forecasting, enhancing dependability and agility. Overall, AI-driven SCADA systems offer smarter automation, lower operational costs, and reduced need for human intervention.

Get Sample Link @https://www.precedenceresearch.com/sample/6341

Market Overview

The Power SCADA market provides critical command-and-control systems for electric utilities and industrial power infrastructure. SCADA solutions combine field hardware (RTUs, MTUs, PLCs, communication devices and HMIs), control and supervisory software, network infrastructure, and professional services.

These systems collect and process telemetry data from substations, power lines, generation units and DER sites, allowing real‑time monitoring, remote control, fault detection and automated decision support. Historically built on proprietary architectures, today’s Power SCADA platform migration emphasizes open standards, modular scalability, cloud and edge deployments, and AI‑driven analytics.

Drivers

-

Infrastructure modernization needs: Aging grid assets, especially in markets such as North America, drive modernization via SCADA upgrades for reliability, resilience and automation.

-

Renewable and DER integration: The variable nature of solar, wind and storage requires SCADA systems capable of coordinating DERs, managing intermittent flows and supporting smart grid balancing.

-

Digital transformation and IoT: The deployment of IoT sensors and big data analytics enables utilities to harness real‑time insights, streamline maintenance and enhance operational efficiency.

-

Cybersecurity urgency: As cyberattacks against energy infrastructure rise, stringent regulatory frameworks and threat exposure demand secure SCADA systems with encryption, intrusion detection, and network segmentation.

-

Growing electricity demand: Electrification of transport, data centers, and industry drives volume growth in power demand and complexity, fueling adoption of advanced SCADA for efficient grid management.

Opportunities

-

Cloud migration and software-as-a-service offerings: Cloud-based SCADA reduces capital expense, enables remote monitoring, and simplifies scalability, unlocking opportunities for managed SCADA services.

-

AI and ML for predictive operational intelligence: Embedding machine learning for anomaly detection, equipment failure forecasting, and adaptive control gives providers a competitive edge.

-

Expansion across Asia-Pacific: Nations like India, China and Southeast Asia are investing heavily in substation automation and DER-friendly infrastructure—creating ripe demand.

-

Integration with smart cities and electrification projects: SCADA systems that interface with smart grid, smart building, microgrid and EV charging infrastructures can serve as central orchestration layers.

-

Cybersecurity-as-a-service coupled with SCADA: Utilities may prefer bundled SCADA platforms with managed cybersecurity, training, and compliance services to mitigate vulnerabilities and ease regulatory burden.

Challenges

-

Upfront investment and operational expense: Costly hardware procurement, customization and training make SCADA adoption prohibitive for small or resource-constrained utilities.

-

Security vulnerabilities and legacy exposure: Older SCADA installations often use insecure communication protocols and lack segmentation, exposing critical systems to cyber threats.

-

Workforce skill shortages: Specialized skills are needed to manage modern SCADA technologies, including protocol knowledge, digital control integration, cybersecurity, and analytics—capabilities in short supply.

-

Standardization and interoperability barriers: Adoption of open architectures like IEC 61850 helps, but many utilities still run legacy or proprietary systems that require complex bridging solutions.

-

Regulatory complexity and compliance overhead: Jurisdictional variation in cybersecurity, cloud deployment and system certification requirements complicates global deployment and product strategy.

Recent Developments

-

Vendor innovations: In May 2025, ABB’s OmniCore platform was integrated into SCADA systems, equipping utilities with AI analytics and enhanced grid resilience. Schneider Electric’s EcoStruxure upgrade in April 2025 prioritized predictive maintenance and cyber-hardened controls. Siemens’ March 2025 MindSphere update improved IoT connectivity for real‑time analytics in both North America and Asia. Honeywell introduced a cloud‑based version of Experion SCADA in early 2025, featuring improved data visualization and predictive algorithms.

-

Surge in cloud deployments: Utilities in developed markets are embracing cloud-native SCADA for flexible operation and easier remote access, often paired with edge compute at substations.

-

Cyber strategy integration: Providers are embedding zero‑trust protocols, multifactor access, network segmentation, encrypted communication and AI intrusion detection into SCADA platforms.

-

Focus on IoT & 5G: Vendors are enhancing SCADA offerings with 5G connectivity, edge compute and IoT integration to support low-latency, high‑density deployments.

-

Regulation‑driven expansion: National governments continue to mandate SCADA adoption for grid upgrades, substation automation, and cyber‑resilient infrastructure.

-

Asia Pacific accelerates adoption: Rapid industrialization and renewable energy integration in countries such as India, China, Indonesia and Malaysia drive SCADA deployment across utilities, microgrids and smart city frameworks.

Power SCADA Market Companies

- Siemens AG

- ABB Ltd.

- Schneider Electric SE

- General Electric Company

- Emerson Electric Co.

- Eaton Corporation plc

- Mitsubishi Electric Corporation

- Honeywell International Inc.

- Rockwell Automation, Inc.

- Hitachi Energy

- Toshiba Corporation

- Yokogawa Electric Corporation

- Larsen & Toubro Limited

- Open Systems International (OSI)

- Indra Sistemas S.A.

- ETAP (Operation Technology Inc.)

- ZIV Automation

- Ingeteam

- SCADAfence

- Advantech Co., Ltd.

Segments Covered in the Report

By Component

- Hardware

- RTU (Remote Terminal Unit)

- PLC (Programmable Logic Controller)

- HMI (Human-Machine Interface)

- Communication Systems

- Other Control Units

- Software

- Real-Time Monitoring Software

- Energy Management Systems

- Automation and Control Software

- Services

- Consulting

- Integration & Implementation

- Support & Maintenance

- Training & Education

By Architecture

- Open System Architecture (OSA)

- Closed System Architecture

By Deployment Model

- On-Premises

- Cloud-Based

- Hybrid

By End-Use Industry

- Power Generation

- Renewable Power Plants (Solar, Wind, Hydro)

- Non-Renewable (Coal, Nuclear, Gas)

- Transmission

- Distribution

- Oil & Gas

- Utilities

- Metals & Mining

- Transportation

- Manufacturing

- Others (Commercial, Data Centers, etc.)

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Also Read@ https://www.precedenceresearch.com