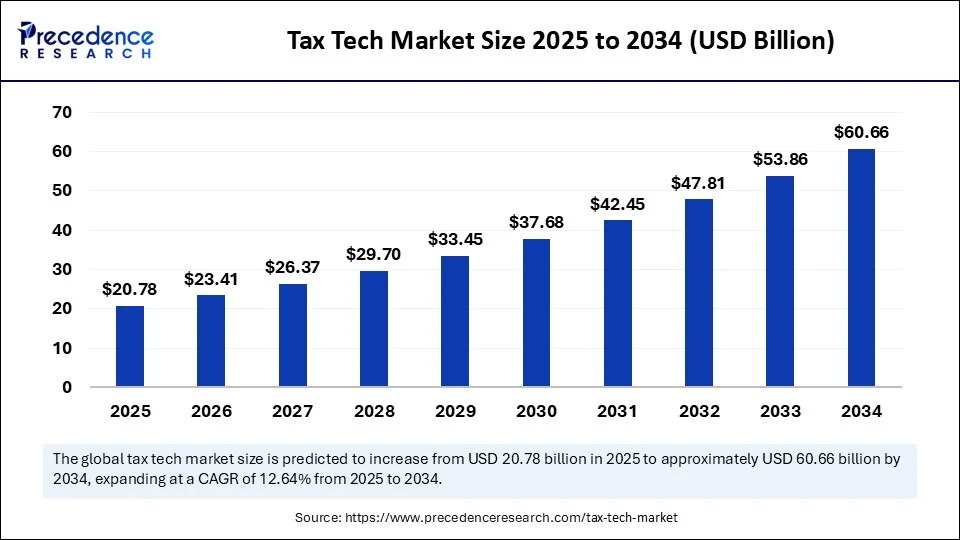

- The global tax tech market was valued at USD 18.45 billion in 2024.

- It is forecasted to reach USD 60.66 billion by 2034, growing at a CAGR of 12.64% from 2025 to 2034.

- North America led the market with the largest share of 39% in 2024.

- Asia Pacific is anticipated to grow at the fastest CAGR in the upcoming years.

- By component, software held the largest market share in 2024.

- The services segment is projected to grow at the fastest CAGR during the forecast period.

- By tax type, indirect tax accounted for a considerable share in 2024.

- The property tax segment is expected to grow at a significant CAGR through the studied period.

- By technology, AI and ML dominated the market in 2024.

- The blockchain segment is projected to grow at a notable CAGR over the forecast years.

- By enterprise size, large enterprises captured the highest market share in 2024.

- The SMEs segment is likely to expand at the fastest CAGR going forward.

- By industry vertical, BFSI held the largest share in 2024.

- The Retail & E-commerce sector is expected to grow rapidly during the forecast period.

Role of AI on the Tax Tech Market

Artificial intelligence is revolutionizing tax technology by automating routine processes, enhancing accuracy, and strengthening fraud detection. It enables tax professionals to focus on higher-value strategic tasks by handling complex data analysis and decision-making. AI’s ability to process vast datasets, deliver real-time insights, optimize operations, and apply predictive analytics makes it a powerful tool for improving efficiency, reducing costs, and ensuring regulatory compliance in tax systems. The growing trend of digitalization is accelerating the adoption of AI in tax management solutions. Large enterprises are increasingly integrating AI into their existing systems and software to streamline tax compliance and reporting, thereby enhancing precision and meeting evolving regulatory demands.

Market Overview

The Tax Tech Market is undergoing a transformative shift driven by increasing demand for digital solutions that simplify complex tax processes. Organizations across industries are embracing tax technology platforms to manage evolving tax regulations, enhance compliance, and reduce operational inefficiencies. The growing need for real-time tax reporting, improved accuracy, and data-driven insights has positioned the Tax Tech Market as a crucial segment within the financial technology landscape. Enterprises are transitioning from traditional manual tax practices to automated, software-driven approaches that streamline everything from VAT compliance to transfer pricing and international taxation.

Cloud-based tax solutions, artificial intelligence, machine learning, and robotic process automation are rapidly becoming standard components in this evolving ecosystem, allowing businesses to adapt to global tax complexities with agility.

Drivers

A primary driver of growth in the Tax Tech Market is the rise in regulatory scrutiny and the growing complexity of global tax laws. Governments are increasingly enforcing digital tax reporting standards, such as e-invoicing and real-time reporting, compelling businesses to adopt technology-based tax systems. The need for accurate and timely tax reporting has become critical, especially for multinational companies operating across multiple jurisdictions. In addition, the widespread integration of artificial intelligence and automation in enterprise systems is fueling demand for intelligent tax technologies that reduce manual intervention and minimize human error. Cost efficiency, faster return on investment, and the growing adoption of cloud platforms are also pushing organizations to digitize their tax functions.

Opportunities

The Tax Tech Market presents significant opportunities, particularly in the realm of AI-driven tax analytics and predictive compliance management. As organizations generate vast volumes of financial data, tax technology solutions that can extract actionable insights and forecast tax obligations are gaining traction. Emerging economies are showing high potential for market expansion as businesses modernize their tax infrastructure. There’s also growing demand for integrated tax management platforms that unify corporate tax, indirect tax, and property tax reporting. Moreover, as environmental, social, and governance (ESG) compliance grows in prominence, tax solutions that support ESG-aligned reporting and green tax initiatives present a new frontier for innovation and differentiation in the Tax Tech Market.

Challenges

Despite the momentum, the Tax Tech Market faces challenges related to data privacy, system integration, and user adoption. Implementing advanced tax technology solutions often requires significant investment in infrastructure, training, and change management, which may deter smaller enterprises. Additionally, varying tax regulations across jurisdictions make it difficult to create universally adaptable platforms. Cybersecurity threats and data breaches are also a growing concern, especially with the increased reliance on cloud-based platforms. Resistance to automation within traditional finance departments, lack of skilled personnel, and interoperability issues between existing ERP systems and tax tech software can further hinder market growth.

Regional Insights

Geographically, North America holds the largest share in the Tax Tech Market, driven by the early adoption of digital tax platforms, robust technological infrastructure, and the presence of leading vendors. The United States, in particular, has witnessed rapid integration of AI and analytics tools into tax functions. Europe is also a significant contributor, supported by regulatory initiatives such as SAF-T (Standard Audit File for Tax) and Making Tax Digital (MTD) in the UK.

Meanwhile, the Asia-Pacific region is emerging as the fastest-growing market due to economic expansion, rising digital transformation, and the adoption of e-invoicing mandates in countries like India, Australia, and China. Latin America and the Middle East are also experiencing increased adoption, especially in sectors such as retail, BFSI, and e-commerce.

Recent Developments

The Tax Tech Market has seen numerous developments in recent years. Key players have been focusing on AI-enabled compliance tools, cloud-native tax solutions, and integrated dashboards that offer real-time insights and alerts. Strategic partnerships between tax software providers and ERP vendors have become common, enhancing the seamless deployment of tax tech modules. For instance, major software vendors are introducing blockchain-enabled transaction tracking and AI-powered audit systems to boost transparency and compliance. Investments in R&D are increasing, with a focus on machine learning algorithms that adapt to changing tax laws. Additionally, many companies are localizing their offerings to meet regional tax requirements, expanding their presence across global markets.

Tax Tech Market Companies

- Ernst & Young Global Limited

- Consulting Services LLP

- Vertex Inc.

- Avalara, Inc.

- KPMG Assurance

- Transfer Pricing Associates BV

- Grant Thornton Advisors LLC

- Deloitte Touche Tohmatsu Limited

- SAP SE

- Wolters Kluwer N.V.

- Thomson Reuters

- Sovos Compliance

- Xero Limited

- TaxJar

Resent Developments

- In March 2025, EY collaborated with NVIDIA AI to launch EY.ai Agentic Platform to drive multi-sector transformation, starting with tax, risk, and finance domains.

- In March 2025, Town, a U.S.-based start-up specializing in SME tax solutions, debuted with an $18 million seed round led by venture capital firm First Round Capital.

Segments Covered in the Report

By Component

- Software

- Tax Compliance Software

- Tax Planning and Management Software

- Others

- Services

- Implementation Services

- Support and Maintenance

- Others

By Tax Type

- Direct Tax

- Indirect Tax

- Property Tax

- Payroll Tax

- Others

By Technology

- Robotic Process Automation (RPA)

- Big Data and Analytics

- Natural Language Processing (NLP)

- Blockchain

- Artificial Intelligence (AI) and Machine Learning (ML)

- Others

By Enterprise Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By Industry Vertical

- Pharmaceutical & Healthcare

- Banking, Financial Services, and Insurance (BFSI)

- IT and Telecom

- Retail & E-commerce

- Oil & Gas

- Manufacturing

- Government

- Others

By Region

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Get Sample Link@ https://www.precedenceresearch.com/sample/6293